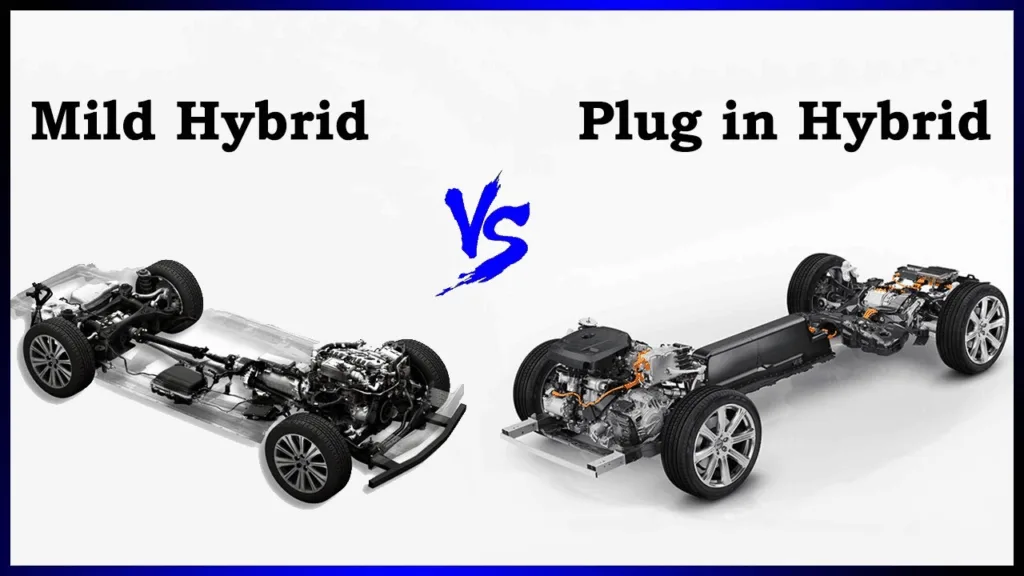

Imagine being told Hyundai electric vehicles are the future, investing billions in EV infrastructure, then watching hybrids quietly outsell your battery-electric models three-to-one. That’s exactly where Hyundai finds itself in 2025—and it’s forcing the Korean giant to dramatically rethink its electrification playbook for India.

Table of Contents

The Numbers That Changed Everything

While Hyundai publicly champions its electric vision with models like the Creta EV and Ioniq 5, the market is sending a different message. In India, hybrids are experiencing explosive growth while pure EVs struggle with infrastructure anxiety and premium pricing.

India’s Electrification Reality Check:

| Powertrain Type | 2023 Market Share | Current Growth Trend | Key Players |

|---|---|---|---|

| Pure EVs | ~2% of total sales | Steady but slow | Tata, Mahindra, MG |

| Hybrids (HEV) | ~2% of total sales | Surging rapidly | Toyota (78%), Maruti (20%) |

| Strong Hybrids | Minimal | Emerging segment | Toyota dominance |

| Traditional ICE | ~96% | Still dominant | All manufacturers |

The reality? Despite identical market shares, hybrids are growing faster because they eliminate range anxiety while delivering fuel efficiency improvements. Toyota commands a staggering 78% share of India’s hybrid market, followed by Maruti Suzuki at 20% and Honda at 2%—leaving Hyundai completely absent from this booming segment.

The Tax Problem: 43% vs 5%

Here’s the absurdity: India imposes a 43% goods and services tax on hybrids compared to just 5% on pure electric vehicles. Yet hybrids are still winning consumer preference.

Why Hybrids Thrive Despite Tax Penalty:

| Consumer Concern | EV Reality | Hybrid Solution |

|---|---|---|

| Charging infrastructure | Limited, unreliable | Not needed—uses petrol stations |

| Range anxiety | Real issue for long trips | 900+ km range with fuel + battery |

| Purchase price | Premium even with subsidies | More affordable despite 43% tax |

| Resale value | Uncertain, battery degradation fears | Proven technology, stable value |

| Daily usability | Planning required | Works like regular car |

The 43% tax disadvantage isn’t stopping buyers because peace of mind trumps tax savings. This consumer behavior is forcing Hyundai to abandon its EV-only approach for India.

The Strategic Pivot: Hybrids by 2026-2028

After watching Toyota and Maruti dominate the hybrid space while its Ioniq 5 EV remains a niche product, Hyundai is making a historic shift.

Hyundai’s New Hybrid Timeline:

| Model | Launch Year | Details | Target Segment |

|---|---|---|---|

| Palisade Hybrid | 2028 | First hybrid for India, flagship SUV | Premium (₹30+ lakh) |

| Creta-sized Hybrid SUV | 2026-2027 | Under development in China | Mid-size (₹15-20 lakh) |

| Next-gen Creta Hybrid | 2028 (Feb) | SX3 platform with hybrid option | Mass market |

| 18+ Global Hybrids | By 2030 | Including Genesis luxury hybrids | All segments |

The Palisade Hybrid arriving in 2028 will be Hyundai’s flagship above ₹30 lakh, featuring next-generation TMED-II technology promising better performance and fuel efficiency. But the real game-changer is the Creta-sized hybrid SUV expected by 2026-2027—directly targeting India’s hottest segment where Toyota Urban Cruiser Hycross and Maruti Grand Vitara dominate.

The 1.2L Turbo-Petrol: Foundation for Hybrid Future

Hyundai is developing a new 1.2-litre turbo-petrol engine specifically as the base for future hybrid applications. This engine will power mass-market hybrids down the lineup, making hybrid technology accessible beyond just premium segments.

Why This Matters:

Currently, Hyundai’s smallest hybrid-capable engine is larger and more expensive, limiting hybrid adoption to premium models. The new 1.2L turbo opens the door to Venue-sized and Creta-class hybrid SUVs at competitive prices—essential for competing with Maruti and Toyota’s aggressive hybrid expansion.

The 26-Model Blitz: Hybrid, EV, and ICE

Hyundai’s response to slipping market share (recently falling behind Tata and Mahindra in monthly sales) is nothing short of nuclear: 26 new models by 2030 across all powertrains.

The Complete Product Onslaught:

| Product Category | Model Count | Timeline | Strategic Purpose |

|---|---|---|---|

| All-new models | 7-8 vehicles | 2025-2030 | Fill segment gaps |

| Facelifts/variants | 18+ updates | Rolling basis | Keep lineup fresh |

| Pure EVs | 6 models | Through 2030 | Long-term vision |

| Hybrids | Multiple models | 2026-2030 | Immediate growth |

| ICE vehicles | Ongoing | Continuous | Maintain volume base |

This isn’t just product refreshment—it’s a desperate attempt to reclaim Hyundai’s long-held No. 2 position in India after Tata and Mahindra aggressively captured market share with SUV-heavy lineups and early EV moves.

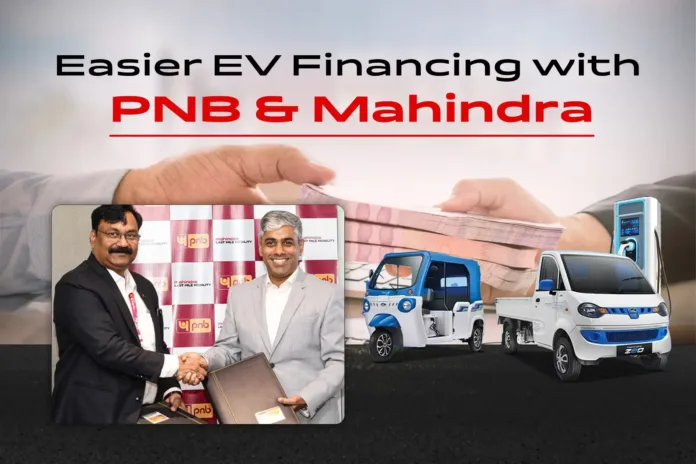

India’s First Locally-Designed EV: The HE1i

While pivoting to hybrids, Hyundai isn’t abandoning EVs. The company confirmed India will receive its first EV designed specifically for local drivers, backed by a localized supply chain.

The India-Specific EV Strategy:

Autocar Professional exclusively reported the upcoming EV is a sub-compact SUV codenamed HE1i, likely positioned below the Creta EV to target affordability-conscious buyers.

Expected HE1i Details:

| Specification | Expected Reality | Competitive Context |

|---|---|---|

| Segment | Sub-compact SUV | Competes with Tata Nexon EV, Mahindra XUV400 |

| Platform | 400V cost-optimized | Emerging market-specific architecture |

| Price target | ₹12-18 lakh | Accessible to mass market |

| Range | 350-400 km | Practical for city + highway |

| Launch | Post 2027-28 | After hybrid momentum builds |

| Production | Localized in India | Lower costs, faster delivery |

Hyundai has engaged with Exide Industries and Amara Raja to localize battery packs, dramatically reducing costs compared to imported batteries in the Ioniq 5. Local management stated the goal is achieving higher EV share than in ICE portfolio—an ambitious target given Hyundai is currently India’s second-largest carmaker in combustion vehicles.

The Pune Expansion: 250,000 Units Added

Infrastructure investment backs up product promises. Hyundai’s Pune multi-model export hub will expand capacity by 250,000 units by 2030, contributing to the company’s global plan to add 1.2 million units of production capacity.

What 250,000 Additional Units Means:

- Export Strength: Pune becomes major hub for global markets, not just domestic

- Model Flexibility: Multi-model platform allows quick response to market shifts

- Hybrid Production: Capacity includes hybrid and EV assembly lines

- Cost Advantage: Scale reduces per-unit costs for competitive pricing

This expansion positions India not just as a consumption market but as a manufacturing powerhouse for Hyundai’s global electrification strategy.

The Competitor Pressure: Why Hyundai Can’t Wait

Once the undisputed No. 2 carmaker, Hyundai recently slipped behind Tata Motors and Mahindra in monthly sales rankings. This isn’t minor fluctuation—it’s a structural shift threatening Hyundai’s decades-long market position.

What Went Wrong:

| Competitive Threat | How They Won | Hyundai’s Gap |

|---|---|---|

| Tata Motors | Early EV leadership, SUV focus | Late to mass-market EVs |

| Mahindra | Aggressive SUV launches, BE/XEV EVs | Product refresh slowdown |

| Maruti-Toyota | Hybrid dominance (Grand Vitara, Hyryder) | Zero hybrid presence |

| MG Motor | Value EVs (ZS EV, Comet) | Premium-only EV strategy |

The irony? Hyundai possesses world-class hybrid and EV technology but deployed it too slowly in India, allowing domestic rivals and Toyota-Maruti to capture momentum.

The Global Context: 60% Electrified by 2030

Globally, Hyundai targets 5.55 million vehicle sales by 2030, with electrified vehicles accounting for 60% (3.3 million units), led by growth in North America, Europe, and Korea.

Global vs India Strategy Divergence:

| Market | Electrification Priority | Consumer Reality |

|---|---|---|

| Europe | Pure EVs dominate | Strict emission regulations, charging infrastructure |

| North America | Hybrids + EVs balanced | Tax incentives, range concerns |

| Korea | EV-focused | Advanced infrastructure, government support |

| India | Hybrids becoming priority | Infrastructure gaps, price sensitivity |

The company will expand its hybrid lineup to more than 18 models by 2030, including Genesis hybrids from 2026. This massive hybrid expansion reflects Hyundai’s recognition that emerging markets like India need transitional technology before pure EV adoption accelerates.

The Extended-Range EV (EREV): Third Option Emerges

Hyundai plans to begin mass production of new Extended-Range Electric Vehicles (EREV) in North America and China by end of 2026, with sales starting 2027.

What is EREV?

Think of it as a hybrid where the petrol engine only generates electricity—it never directly drives the wheels. The vehicle operates as a pure EV until the battery depletes, then the engine kicks in as a generator, extending range beyond 900 km.

EREV Advantages:

| Benefit | How It Works | Consumer Appeal |

|---|---|---|

| EV driving experience | Electric motors always power wheels | Instant torque, quiet operation |

| No charging anxiety | Refuel at any petrol station | Eliminates infrastructure concerns |

| Battery cost savings | Smaller battery than pure EVs | More affordable pricing |

| Superior range | 900+ km total range | Longer than most pure EVs |

Hyundai’s EREV targets 80,000+ units in North America and 30,000+ units in China initially, with India expansion possible if the technology gains traction.

The Investment Scale: ₹77.3 Trillion Through 2030

Hyundai’s CFO raised the revenue growth target to 5-6% and announced a ₹77.3 trillion (KRW) investment plan through 2030, including ₹30.9 trillion for R&D.

To put this in perspective:

- ₹77.3 trillion KRW ≈ $60 billion USD

- ₹30.9 trillion KRW ≈ $24 billion USD in R&D alone

This staggering investment spans EV development, hybrid technology, battery partnerships, production capacity expansion, autonomous vehicles, and software-defined vehicle platforms. The scale signals Hyundai views the 2025-2030 period as existential—win now or lose market position permanently.

The Battery Technology: 30% Cost Reduction Target

The company targets a 30% reduction in battery costs, with cloud-based battery management systems from 2026 and rollout of its Pleos operating system to enable software-defined vehicles.

Why This Matters for India:

| Technology Advance | Impact | India Benefit |

|---|---|---|

| 30% battery cost cut | EVs become price-competitive with ICE | Mass adoption becomes feasible |

| Cloud battery management | Real-time monitoring, preventive maintenance | Addresses battery degradation fears |

| Software-defined vehicles | Over-the-air updates, feature additions | Cars improve after purchase |

| Local battery assembly | Exide, Amara Raja partnerships | Avoids import duties, faster supply |

If Hyundai achieves 30% battery cost reduction by 2028-2030, its India-specific EVs could price competitively with Tata’s Nexon EV and Mahindra’s XUV400—finally making premium Korean engineering accessible to mainstream buyers.

The Charging Infrastructure Gap: Why Hybrids Win

Let’s be brutally honest about why hybrids are outselling EVs in India:

India’s EV Infrastructure Reality:

- Total public charging points: ~16,000 (as of 2024)

- EV-to-charger ratio: 135 vehicles per charger (global average: 6-20)

- Highway charging corridors: Incomplete, unreliable

- Apartment charging: Mostly unavailable due to society approvals

- Charging time: 45-60 minutes even with fast charging

Compare this to hybrids: 80,000+ petrol pumps nationwide, 5-minute refueling, zero new infrastructure needed.

Until India’s charging network approaches petrol station density—realistically a 2030+ scenario—hybrids offer the path of least resistance for buyers wanting fuel efficiency without lifestyle compromise.

The Toyota Threat: 78% Hybrid Market Share

Toyota commands 78% of India’s hybrid market, followed by Maruti Suzuki at 20% and Honda at 2%. Hyundai’s complete absence from this list is strategic failure.

How Toyota Won the Hybrid Battle:

| Toyota Strategy | Result | Hyundai’s Gap |

|---|---|---|

| Early entry (2019) | First-mover advantage | Waited until 2026-2028 |

| Multiple models | Camry, Hycross, Innova Hycross | Zero models currently |

| Proven reliability | Decades of global hybrid experience | No India hybrid track record |

| Aggressive pricing | Made hybrids accessible | Only premium EVs so far |

Hyundai is now playing catch-up in a segment where Toyota has spent years building trust and infrastructure. Clawing back market share will require aggressive pricing and superior technology—both of which Hyundai possesses but must execute quickly.

The Bottom Line: Hyundai’s Reality Check

Hyundai entered India’s electrification race believing pure EVs were the answer. The market replied: “Not yet.” Hybrids are outselling EVs because Indian consumers prioritize practicality over environmental idealism when spending ₹15-30 lakh.

The 26-model product offensive through 2030 represents Hyundai’s acknowledgment that electrification isn’t one-size-fits-all. India needs hybrids as a bridge technology while charging infrastructure catches up. The country needs affordable, locally-designed EVs, not just imported premium models. And India needs variety—giving buyers choice rather than forcing them toward technology they’re not ready for.