EV Loan Guide

As the global movement towards sustainable transportation gains momentum, there has been a noticeable shift from traditional petrol and diesel vehicles to electric vehicles (EVs). This transition is driven by increasing environmental awareness and technological innovations. Recognizing the importance of this shift, the Government of India has taken proactive steps to encourage the adoption of EVs by offering various tax benefits and incentives to consumers.

Contents

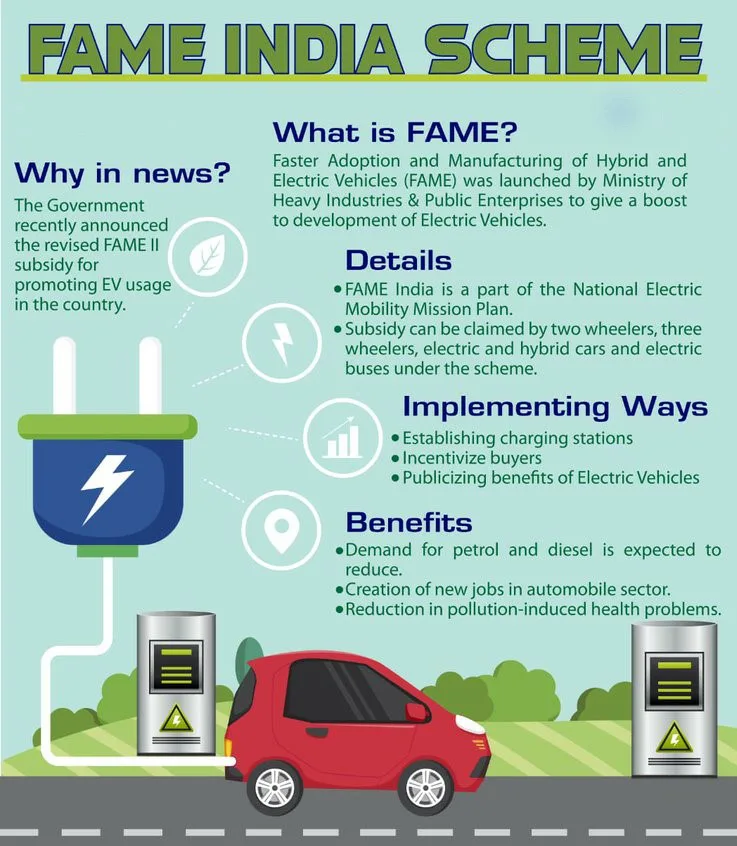

Government Initiatives

The Government of India aims to boost the uptake of electric vehicles by providing tax incentives and financial benefits. These measures are designed to make EVs more accessible and affordable for the average consumer, thereby reducing the country’s carbon footprint and fostering a cleaner environment.

Financing Options

To further facilitate the purchase of electric vehicles, a range of financing options is available through various financial institutions. These options help bridge the gap for potential EV buyers who are looking for financial support to make the transition.

Types of Financiers

- Banks: Traditional banking institutions offer EV loans with competitive interest rates and flexible terms.

- Non-Banking Financial Companies (NBFCs): These institutions provide tailored financial products for EV purchases, often with fewer bureaucratic hurdles than banks.

- Small Finance Banks (SFBs): SFBs focus on providing credit access to underserved segments, making them a viable option for personal EV financing.

Categories of Loans

- Personal Use Loans: These loans cater to individuals looking to purchase electric two-wheelers, three-wheelers, or cars for personal use.

- Commercial Use Loans: Designed for businesses, these loans support the acquisition of electric vehicles for commercial purposes, including fleets of cars, UVs, and buses.

Segments Covered

- Two-Wheelers: Ideal for short commutes and city travel.

- Three-Wheelers: Commonly used for commercial transport and goods delivery.

- Cars and Utility Vehicles (UVs): Suitable for both personal and commercial use.

- Buses: Focused on public transportation and large-scale passenger movement.

Loan Details

When considering an EV loan, it’s important to understand the financial terms, which can vary depending on the financier and loan category:

- Interest Rates: These rates can fluctuate based on market conditions and the financier’s policies.

- Loan-to-Value (LTV) Ratios: This indicates the percentage of the vehicle’s value that can be financed through a loan.

- Tenure: Loan tenures are typically flexible, ranging over several months, allowing borrowers to choose a repayment schedule that suits their financial situation.

- EMI per Lakh: This metric helps borrowers estimate the monthly installment they would need to pay for every lakh borrowed.

By understanding these components, potential EV buyers can make informed decisions and select the most suitable financing option for their needs. With the right financial support, transitioning to an electric vehicle has never been more achievable.

Two Wheelers EV Loan Guide – Best Car Loan Interest rates

Bank – Personal

Summary

| Interest Rates (%) | LTV (%) | Tenure (months) | EMI per Lakh (Rs.) |

|---|---|---|---|

| 12-18% | 60-80% | 12-24 | ₹ 4,367 |

Bank Details

| Banks | Interest Rates (%) | LTV (%) | Tenure (months) | Link |

|---|---|---|---|---|

| Click here | |||

| Click here | |||

| Click here |

NBFCs – Personal

Summary

| Interest Rates (%) | LTV (%) | Tenure (months) | EMI per Lakh (Rs.) |

|---|---|---|---|

| 15-25% | 60-80% | 6-24 | ₹ 3,978 |

Bank Details

| Banks | Interest Rates (%) | LTV (%) | Tenure (months) | Link |

|---|---|---|---|---|

| Up to 25% (Annualised Reducing Rate) OR 14% Flat Interest Rate | 90% of On-road Price(Rs. 30,000 – Rs.1.00 lakh) | 3 – 15 Months | Click here |

| 1.08-1.24% per month | 12 – 24 months | Click here | |

| 6-24 months | Click here | ||

| Upto 85% Financing available | Click here | ||

| 85% | Click here | ||

| Upto 85% Financing available | Click here | ||

| 18-30% | 3-60 months | Click here | |

| Click here | ||||

| Upto 75% | Upto 24 months | Click here | |

| Click here | |||

| Click here | |||

| Click here | |||

| Click here | |||

| Click here | |||

| Click here |

Four wheelers EV Loan Guide – Best Car Loan Interest rates

Bank – Personal

Summary

| Interest Rates (%) | LTV (%) | Tenure (months) | EMI per Lakh (Rs.) |

|---|---|---|---|

| 6.5-11% | 90-95% | 36-48 | ₹ 2,565 |

Bank Details

| Banks | Interest Rates (%) | LTV (%) | Tenure (months) | Link |

|---|---|---|---|---|

| 7.05-7.75% | Click here | ||

| 7.49% | Click here | ||

| 80-85% | Click here | ||

| 6.75% | Click here |

NBFCs – Personal

Summary

| Interest Rates (%) | LTV (%) | Tenure (months) | EMI per Lakh (Rs.) |

|---|---|---|---|

| 12-18% | 85-90% | 36-48 | ₹ 2,691 |

Bank Details

| Banks | Interest Rates (%) | LTV (%) | Tenure (months) | Link |

|---|---|---|---|---|

| 10.75% | Click here |

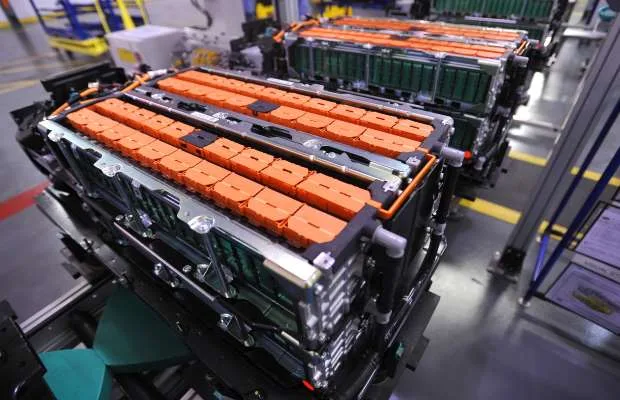

Read more: When will India’s EV sales include Solid State Batteries?