Picture a highway filled with EV Adoption—but drivers anxiously searching for the next available charger. Welcome to India’s EV paradox: booming adoption, lagging infrastructure.

Table of Contents

The Growing Gap Nobody’s Addressing

The 2025 HERE-SBD EV Index reveals a stark reality: India’s ratio of electric vehicles to public chargers has jumped from 12:1 in 2024 to 20:1 in 2025—nearly doubling in just one year. Translation? For every charging point added, two new EVs hit the roads.

This isn’t just statistics. It’s the daily frustration of millions considering the switch to electric.

State-by-State: Who’s Leading, Who’s Lagging?

| State/UT | Score (out of 100) | Key Strength | Notable Feature |

|---|---|---|---|

| Chandigarh | 87.90 | Overall leader | Consistent top performer |

| Karnataka | 2nd place | Infrastructure density | 5,880+ charging stations |

| Goa | 3rd place | EV fleet share | 0.91% of vehicles are EVs |

| Delhi | High ranking | Charger density | 1 charger per 9 km of road |

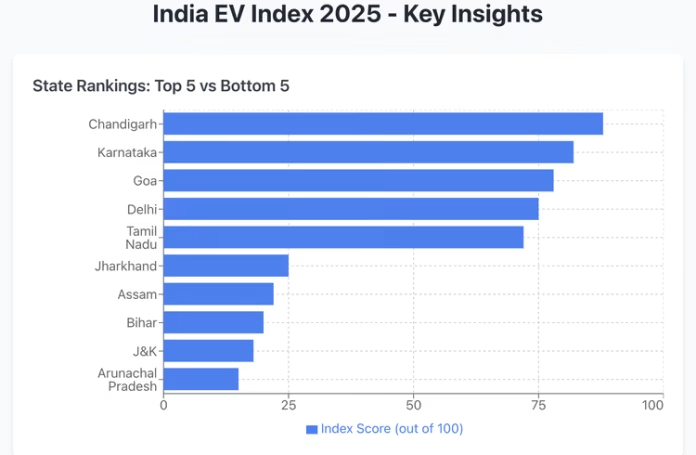

Chandigarh retained its top position with a score of 87.90 out of 100, followed by Karnataka in second place and Goa in third. But even these leaders face challenges keeping pace with surging demand.

What’s Holding India Back?

The perceived lack of charging infrastructure emerged as the top barrier to adoption, cited by 47 percent of respondents. When nearly half your potential customers fear getting stranded, you’ve got a serious problem.

And here’s the kicker: India added 6,800 new public charge points between 2024 and 2025, but the average charger power remained flat at 33 kilowatts. We’re not just building too few chargers—we’re building too many slow ones.

The Numbers Don’t Lie

Consider this reality check:

- 20 EVs per public charger nationally (2025)

- 6,800 new charging points added annually

- 33 kW average charging power (unchanged)

- 47% of consumers cite infrastructure as the #1 barrier

Compare that to developed markets maintaining 6-20 EVs per charger, and India’s infrastructure crisis becomes crystal clear.

The Youth Are Betting on Electric

Here’s where optimism breaks through: Indian EV owners have an average age of 35 years, significantly younger than their counterparts in the United States and European Union, where the average is 46 years.

Even more telling? Nearly half of Indian respondents expect more than 50 percent of vehicles sold in 2030 to be electric. The demand is real—the infrastructure just needs to catch up.

The Policy Shift: FAME II Ends, PM E-DRIVE Begins

The policy landscape shifted following the conclusion of the FAME II programme in September 2024. The PM E-DRIVE scheme now focuses primarily on electrifying two-wheelers, three-wheelers, and commercial vehicles.

This strategic pivot recognizes where India’s real EV revolution is happening: not in luxury sedans, but in the delivery vehicles, auto-rickshaws, and commuter bikes that move millions daily.

Why the Mismatch Matters

The evaluation criteria tell the complete story. The index evaluated regions based on four metrics: charger availability per road length, average power capacity of chargers, EV fleet share, and the ratio of registered EVs to public chargers.

India is winning on EV fleet growth but struggling on infrastructure deployment and charging speed—a dangerous imbalance that could stall adoption momentum.

The Path Forward: Three Critical Needs

1. Speed Matters

With charging power stagnant at 33 kW, we need rapid deployment of 50+ kW fast chargers that can juice up vehicles in minutes, not hours.

2. Strategic Placement

More public charging stations were identified as the most desired improvement by 36 percent of those surveyed. But quantity means nothing if chargers aren’t where drivers need them.

3. Rural Expansion

While urban centers capture headlines, the real opportunity—and challenge—lies in tier-2 and tier-3 cities where EV adoption is accelerating but infrastructure remains scarce.

The Opportunity Hidden in Crisis

Here’s what most analyses miss: this infrastructure gap represents India’s biggest cleantech investment opportunity. Robert Fisher, Senior Consulting Manager at SBD Automotive, noted that India must navigate the distinct requirements of its diverse mobility landscape, as the needs of two- and three-wheeler drivers differ greatly from those of car owners and public transport operators.

This isn’t a one-size-fits-all problem—it’s a multi-layered opportunity for innovative solutions tailored to India’s unique mobility ecosystem.

What This Means for You

If you’re considering an EV: The infrastructure will catch up, but timing matters. Early adopters in tier-1 cities with home charging face minimal risk. Those in smaller cities should wait for local infrastructure maturity.

If you’re an investor: The charging infrastructure sector is screaming for capital. With 20:1 vehicle-to-charger ratios, the market is undersupplied and primed for growth.

If you’re a policymaker: Speed approvals, streamline land acquisition, and mandate minimum charging power standards. The private sector will invest—but only with regulatory clarity.

The Bottom Line

India’s EV adoption isn’t slowing down—it’s accelerating despite infrastructure constraints, not because of them. That speaks volumes about consumer readiness and market demand.

But here’s the hard truth: you can’t sustain rapid EV growth indefinitely on lagging infrastructure. At some point, the 20:1 ratio becomes 30:1, then 40:1, and adoption stalls as range anxiety wins.

The window to bridge this gap is now. The demand exists. The young demographic is ready. The policy support is emerging.

What’s missing? The political will to treat charging infrastructure as critical national infrastructure—not an afterthought to vehicle incentives, but the foundation upon which India’s electric future will either thrive or stall.

The race is on. And right now, India’s EVs are outrunning their own support system.