India EV Sales, electric vehicle revolution just hit a major milestone. In Q2 FY2025-26, EVs captured nearly 10% of the country’s total automotive market—a figure that would have seemed impossible just a few years ago. Let me walk you through what’s driving this electrifying transformation.

Table of Contents

India EV Sales : EVs Break the 10% Barrier

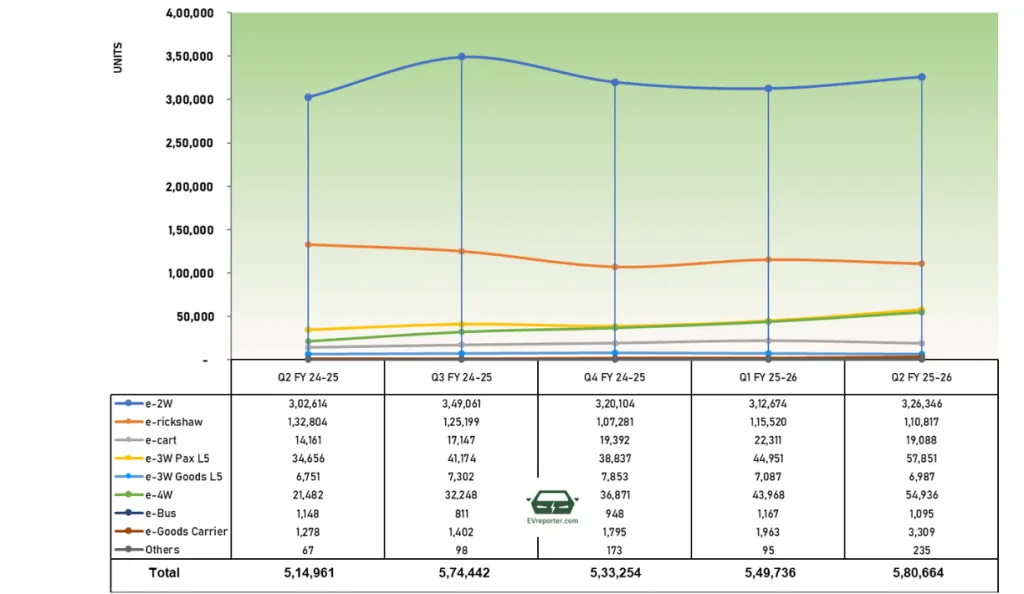

Out of 58.12 lakh vehicles sold across India between July and September 2025, a remarkable 5.80 lakh were electric. That’s a 9.98% penetration rate—the highest India has ever seen. We’re not just talking about a niche market anymore; EVs are becoming mainstream.

Over the past four quarters, India has sold an impressive 22.38 lakh electric vehicles. The momentum isn’t slowing down; it’s accelerating.

Category Breakdown: Who’s Leading the Charge?

Two-Wheelers and Three-Wheelers Dominate

Electric two-wheelers and three-wheelers together command a staggering 89.7% market share among all EV segments. These aren’t luxury purchases—they’re practical, economical choices for millions of Indians navigating daily commutes and last-mile deliveries.

Electric two-wheelers grew by 7.84% year-over-year, adding 23,732 more units compared to last year. Quarter-on-quarter growth stood at a respectable 4.37%.

The Surprise Star: Electric Goods Carriers

Here’s where things get really interesting. Electric goods carriers (think delivery trucks and commercial vehicles) witnessed an explosive 158.92% year-over-year growth—that’s 3,309 additional units on the road. Quarter-on-quarter, this segment surged by 68.57%.

Why? Businesses are discovering that electric commercial vehicles slash operational costs while meeting sustainability targets. It’s a win-win that’s hard to ignore.

Four-Wheelers Gaining Traction

Electric cars and passenger vehicles grew by 155.73% year-over-year. While still a smaller segment, this growth signals that Indian families are increasingly confident in making EVs their primary vehicles.

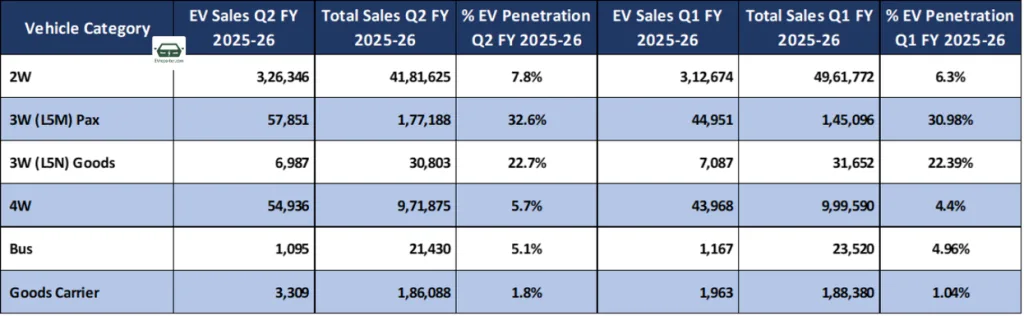

Penetration Rates: Where EVs Are Winning

| Vehicle Category | EV Penetration Q2 FY25-26 | EV Penetration Q1 FY25-26 |

|---|---|---|

| 3W Passenger | 32.6% | 30.98% |

| 3W Cargo | 22.7% | 22.39% |

| 2W (Two-Wheeler) | 7.8% | 6.3% |

| 4W (Four-Wheeler) | 5.7% | — |

| Bus | 5.1% | 4.96% |

Three-wheeler passengers lead the pack with an impressive 32.6% penetration—nearly one in three new auto-rickshaws is now electric. For cargo three-wheelers, it’s 22.7%.

Two-wheelers jumped from 6.3% to 7.8% penetration in just one quarter—a significant leap that reflects growing consumer confidence and improving infrastructure.

Some Speed Bumps Along the Way

Not every category showed growth. E-rickshaws, e-carts, and e-buses experienced minor quarterly declines of 4.07%, 14.45%, and 6.17% respectively. These dips likely reflect seasonal variations and policy adjustments rather than fundamental market weakness.

What This Means for India’s Future

India’s electric vehicle market is transitioning from early adoption to mass acceptance. The 10% penetration milestone isn’t just a number—it’s proof that EVs work for Indian roads, Indian wallets, and Indian businesses.

With commercial segments leading explosive growth and passenger vehicles gaining steady ground, we’re witnessing the foundation of a cleaner, more sustainable transportation ecosystem. The next few quarters will be crucial as infrastructure expands and more affordable models enter the market.

The electric revolution isn’t coming to India—it’s already here, and it’s picking up speed with every passing quarter.