Planning to buy an electric vehicle? Understanding electric vehicle subsidy India schemes can save you lakhs! From FAME II to state-specific benefits, here’s everything you need to claim maximum incentives in 2025.

Table of Contents

Complete Electric Vehicle Subsidy India Overview

| Subsidy Type | Amount | Eligibility | Valid Till |

|---|---|---|---|

| FAME II Central | Up to ₹1.5L | 4-wheeler EVs | March 2026 |

| State Subsidies | ₹50K-3L | Varies by state | Ongoing |

| Income Tax Benefit | Up to ₹1.5L | Section 80EEB | March 2025 |

| GST Reduction | 5% vs 18-28% | All EVs | Permanent |

FAME II: Primary Electric Vehicle Subsidy India

Maximum Benefits: ₹1,50,000 for electric cars and ₹15,000 for electric two-wheelers under the flagship electric vehicle subsidy India program.

How It Works:

- Direct discount at dealership

- No paperwork required from buyers

- Instant price reduction on invoice

- Available for FAME II approved models only

Calculation Formula: ₹15,000 per kWh of battery capacity (capped at 40% of vehicle cost or ₹1.5L, whichever is lower).

State-Wise Electric Vehicle Subsidy India Benefits

| State | Subsidy Amount | Special Benefits | Registration |

|---|---|---|---|

| Delhi | Up to ₹1.5L | Road tax exemption | Free for 3 years |

| Maharashtra | Up to ₹2.5L | SGST waiver | 100% exemption |

| Gujarat | Up to ₹2L | Toll exemption | Reduced fees |

| Karnataka | Up to ₹3L | Parking benefits | Motor vehicle tax waiver |

| Tamil Nadu | Up to ₹1L | Registration waiver | Free registration |

How to Claim Electric Vehicle Subsidy India

Step 1: Check Eligibility

- Verify FAME II approval on official portal

- Confirm state residency requirements

- Ensure vehicle meets technical specifications

Step 2: At Dealership

- FAME II subsidy applied automatically

- State subsidies may require separate application

- Keep all original documents ready

Step 3: Post-Purchase

- Apply for state subsidies within 30-90 days

- Submit required documents to transport department

- Track application status online

Maximum Savings Strategy

Combining Benefits Example (Delhi Resident):

| Component | Amount | Details |

|---|---|---|

| Vehicle Price | ₹15,00,000 | Base EV cost |

| FAME II Subsidy | -₹1,50,000 | Central incentive |

| Delhi Subsidy | -₹1,50,000 | State incentive |

| Road Tax Savings | -₹1,50,000 | 3-year exemption |

| Total Savings | ₹4,50,000 | 30% cost reduction |

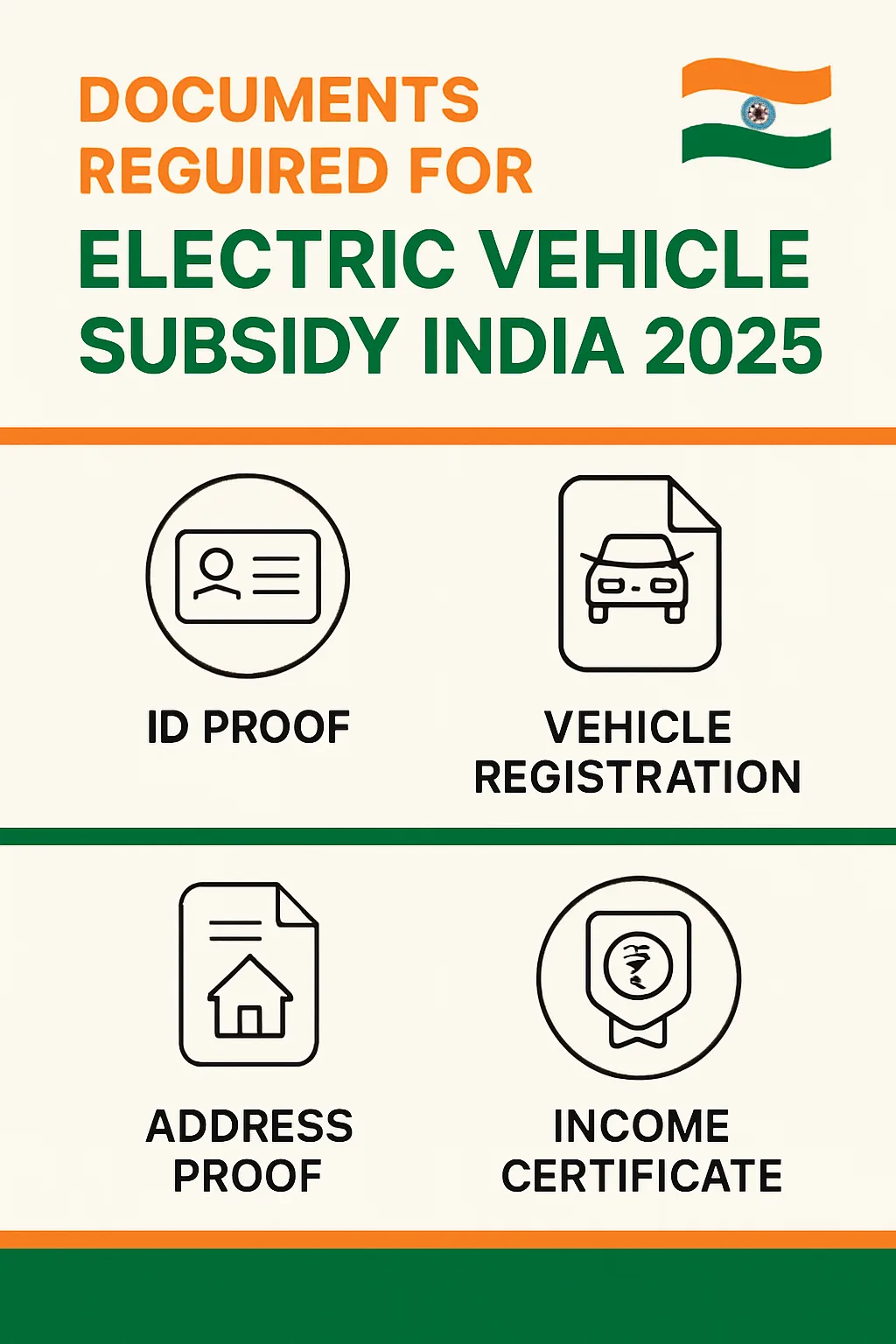

Documents Required

Essential Papers:

- Aadhaar card and PAN card

- Address proof (state-specific)

- Vehicle registration certificate

- Invoice with FAME II discount applied

- Bank account details for state subsidies

Recent Updates in Electric Vehicle Subsidy India (2025)

Extended Timeline: FAME II scheme extended till March 2026 with increased allocation.

New Inclusions: Advanced chemistry cell batteries now qualify for higher incentives.

State Expansions: More states launching dedicated EV policies with enhanced benefits.

Common Mistakes to Avoid

Buying Non-FAME Models: Ensure your chosen EV is FAME II approved to claim central subsidy.

Missing State Deadlines: State subsidies have strict application windows – don’t delay.

Documentation Gaps: Incomplete paperwork can delay or reject subsidy claims.

Future Outlook

2025 Outlook: Government committed to maintaining incentives as India targets 30% EV adoption by 2030.

Policy Direction: Focus shifting from purchase incentives to charging infrastructure development.

Budget Allocation: ₹10,000 crore allocated for EV ecosystem development in current fiscal.

The comprehensive electric vehicle subsidy India framework makes EV ownership significantly more affordable. With proper planning and documentation, buyers can save 20-40% on their electric vehicle purchase.

Stay updated with latest EV policy changes and state-specific incentive programs for maximum benefits.