EV car dealership expecting a government discount on your dream electric vehicle, only to discover the money has run out. That’s exactly what happened to potential EV buyers in three districts of Xian, China’s ancient capital, where local subsidies abruptly ended in June, signaling a potential shift in the world’s largest electric vehicle market.

Table of Contents

The Sudden Stop That Caught Everyone Off Guard

A 2025 government subsidy scheme for electric vehicles and plug-in hybrid purchases ended last month in three districts in the city of Xian, the capital of China’s Shaanxi province, local official media Shaanxi Daily reported on Tuesday.

This isn’t just bureaucratic housekeeping—it’s the first domino in what could become a nationwide trend. The three districts are set to stop accepting applications for the subsidies later in July, leaving countless potential buyers scrambling to understand what happened to their expected discounts.

Why Xian’s Decision Matters Beyond City Limits

Xian isn’t just any Chinese city. Home to the Terracotta Warriors and over 13 million residents, it represents the heartland of China’s industrial transformation. When a city of this significance pulls back on EV incentives, it sends ripples through an industry that has grown accustomed to government support.

Some Chinese cities, including Zhengzhou and Luoyang, suspended trade-in subsidies, suggesting this isn’t an isolated incident but part of a broader pattern of funding challenges across China’s local governments.

The Money Trail Runs Cold

The abrupt ending raises uncomfortable questions about municipal finances. Other cities also face funding shortages, indicating that the golden era of unlimited EV subsidies may be coming to an end, even in China—the world’s most supportive EV market.

Local governments across China have been generous with EV incentives, often offering thousands of yuan in rebates to encourage electric vehicle adoption. But maintaining these programs requires substantial budgets, and it appears some cities are hitting their limits.

What This Means for Chinese EV Buyers

For consumers in Xian’s affected districts, the timing couldn’t be worse. The unfulfilled applications will no longer be accepted past July, meaning buyers who were counting on government support must now pay full price or delay their purchases.

This creates a two-tier market within the same city—some districts with subsidies, others without. It’s a stark reminder of how quickly government policies can change and impact personal financial decisions.

The Broader Industry Implications

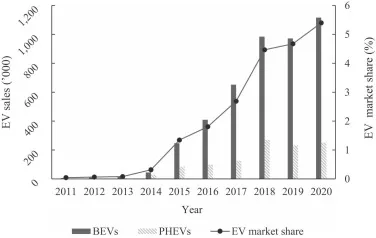

China’s EV market has been turbocharged by government support at every level. China’s EV market grew 40% over 2024, with its monthly EV sales penetration rate surpassing 50%, largely thanks to generous subsidies and tax incentives.

But this success may be breeding its own challenges. As EV adoption becomes mainstream, the question arises: does the industry still need training wheels, or is it ready to compete without government crutches?

The Global Ripple Effect

China’s subsidy policies don’t exist in a vacuum. They influence global EV pricing, manufacturing decisions, and competitive dynamics. If Chinese cities start withdrawing support, it could reshape how international automakers price their vehicles and plan their China strategies.

Looking Ahead: A New Chapter Begins

Future subsidy issuances are scheduled for July and October by state officials, suggesting that while local funding may be drying up, central government support continues.

This transition period represents a critical test for China’s EV industry. Can manufacturers maintain growth momentum without the safety net of local subsidies? The answer will determine whether China’s electric revolution was built on solid foundations or government generosity.

Xian’s subsidy pause may be local news, but its implications are global—marking the beginning of a new, more challenging chapter in the world’s largest EV market.