China EV discounts have hit record highs in 2025. Discover why prices are dropping, which brands are thriving, and how this trend is reshaping the global electric vehicle market.

Table of Contents

Why Are EV Discounts at a Record High in China?

China’s electric vehicle (EV) market has long been a global powerhouse, setting trends and pushing the boundaries of innovation. In 2025, however, the industry is making headlines for a different reason: China EV discounts have reached unprecedented levels, signaling both opportunity and uncertainty for automakers, consumers, and the global EV landscape.

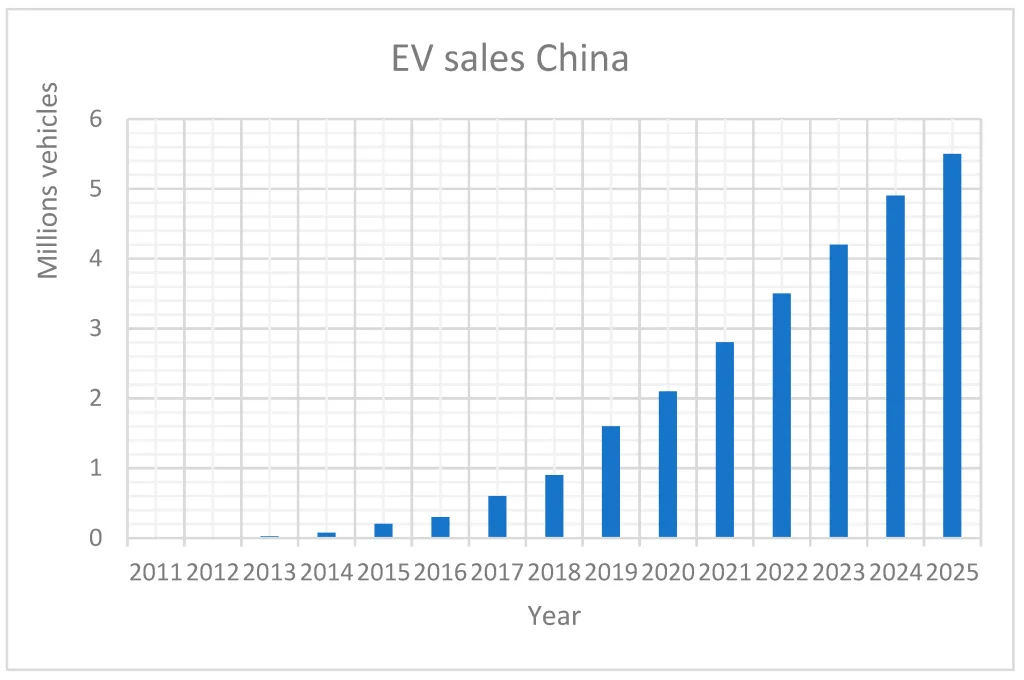

The Rise of China’s EV Industry

Over the past decade, China has rapidly transformed into the world’s largest EV market. With government support, technological advancements, and a growing environmental consciousness, the country now boasts around 50 active EV brands.

These companies have introduced a wide range of models, from affordable city cars to luxury SUVs, all equipped with cutting-edge battery technology and smart features.

Yet, beneath this impressive growth lies a challenging reality. Despite the sheer number of brands and models, only three—BYD, Li Auto, and Seres—are currently profitable. The rest are struggling to break even, let alone turn a profit. This intense competition has set the stage for a price war that is reshaping the entire industry.

Record-High Discounts: What’s Driving the Trend?

In 2025, China EV discounts have soared to record highs. According to a JP Morgan study cited by the South China Morning Post, the average industry-wide discount reached 16.8% in April, up from 16.3% in March.

For comparison, the China Passenger Car Association reported an average discount of just 8.3% for 2024. In December, automakers slashed average EV prices by 10%, further intensifying the competition.

But why are these discounts so high? The answer lies in a combination of factors. First, the sheer number of brands has led to oversupply, with more vehicles on the market than buyers.

Second, domestic demand for EVs, while significant, isn’t growing fast enough to absorb this surplus. As a result, automakers are slashing prices to attract customers and maintain market share, even if it means sacrificing profits.

The Squeeze on Margins

This aggressive discounting has taken a toll on automakers’ bottom lines. The vehicle margin—the difference between the selling price and the total cost of production, including raw materials, labor, and logistics—has dropped to just 10%.

Four years ago, this margin was around 20%. For many companies, such thin margins are unsustainable, especially as they continue to invest in research, development, and marketing.

Industry analysts predict that this situation cannot last forever. Many of China’s smaller EV manufacturers are expected to either exit the market or be acquired by larger rivals in the coming years. Consolidation seems inevitable as only the strongest brands can weather the storm of fierce price competition and shrinking profits.

Betting Big on Exports

With the domestic market under pressure, Chinese EV makers are increasingly looking abroad for growth. Exports have become a crucial strategy, offering better profit margins and access to new customers. In the first four months of 2025, EVs accounted for roughly 33% of China’s total vehicle exports, up from about 25% over the past two years.

International markets, especially in Europe and Southeast Asia, are proving more lucrative for Chinese brands. By expanding overseas, companies hope to offset losses at home and secure their long-term survival. As Nick Lai of JP Morgan notes, “International sales are proving to be more profitable and could provide the breathing space these smaller companies need.”

The Consumer Perspective

For Chinese consumers, these record-high discounts present a unique opportunity. Buyers can now access advanced EVs at historically low prices, making the switch from traditional gasoline vehicles more attractive than ever. However, the rapid pace of change also brings uncertainty.

With so many brands competing and some likely to disappear, consumers may worry about long-term support, resale value, and the stability of their chosen automaker.

What’s Next for China’s EV Market?

Despite the current challenges, China’s EV market remains a global leader in innovation and scale. The ongoing price war is likely to accelerate industry consolidation, with only the most efficient and well-capitalized brands surviving. As the dust settles, consumers can expect a more stable market, continued technological advancements, and potentially even more competitive pricing.

For the rest of the world, China’s experience offers valuable lessons. As Chinese brands ramp up exports, global consumers may benefit from lower prices and greater choice. At the same time, local automakers in other countries will face increased competition, pushing them to innovate and improve their own offerings.

Table: Key Data on China’s EV Discounts (2024-2025)

| Metric | 2024 | April 2025 | Change |

|---|---|---|---|

| Average EV Discount (%) | 8.3% | 16.8% | +8.5% |

| Average Price Cut (Dec 2024) | 10% | — | — |

| Vehicle Margin | 10% | — | -10% (from 20% in 2021) |

| EV Share of Vehicle Exports | 25% | 33% | +8% |

| Profitable EV Brands | 3 | 3 | — |