India EV (electric vehicle) revolution is happening—but not quite the way you might think. October 2025’s sales figures just dropped, and they paint a fascinating picture of where we really stand in the race toward electric mobility. Spoiler alert: traditional engines aren’t going anywhere just yet.

Table of Contents

India EV : How Electric Are We Really?

Let’s cut through the noise with hard numbers. Here’s India’s EV penetration across different vehicle segments in October 2025:

| Vehicle Category | EV Penetration | Change from Sept 2025 | Change from Oct 2024 |

|---|---|---|---|

| Two-Wheelers (2W) | 4.6% | ↓ from 8.1% | ↓ from 6.8% |

| Passenger 3W Autos | 34.3% | ↓ from 37.8% | ↑ from 24.5% |

| Cargo 3W Autos | 16.8% | ↓ from 25.5% | ↓ from 20% |

| Four-Wheelers (4W) | 3.2% | ↓ from 5.3% | ↑ from 2.3% |

| Goods Carriers | 1.5% | ↓ from 2% | ↑ from 0.7% |

Notice something? Most segments saw a dip from September. The electric dream isn’t crashing—it’s just hitting some speed bumps.

Two-Wheeler Battleground: The Surprising Leaders

Hero MotoCorp might sell nearly 10 lakh units monthly, but only 1.6% are electric. That’s just 15,947 EVs out of 9,94,613 total vehicles. The message? India’s largest bike maker is still betting heavily on petrol.

But here’s where it gets interesting: Ather Energy (28,082 units), Ola Electric (16,034 units), and Ampere (7,635 units) are 100% electric players carving out serious market share. Meanwhile, traditional giants like TVS (5.3% EV) and Bajaj (9.6% EV) are hedging their bets across both technologies.

The reality check? Honda, Royal Enfield, Suzuki, and Yamaha sold zero electric bikes in October. Zero.

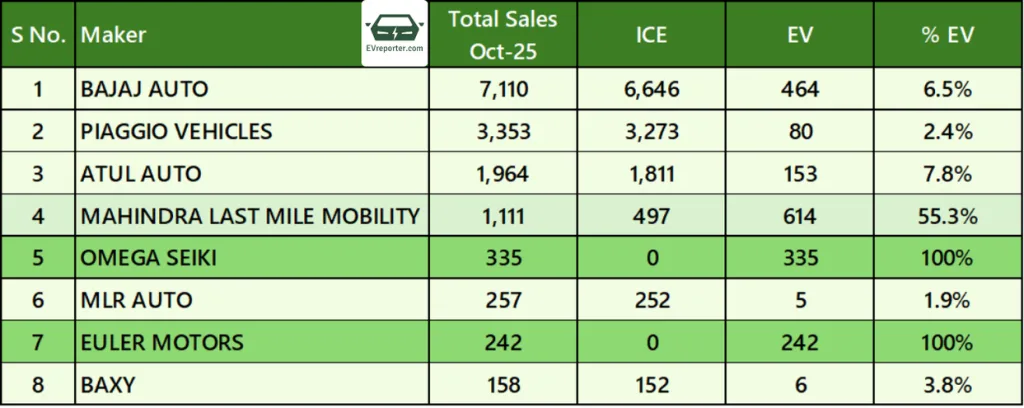

Three-Wheeler Game Changers

If there’s one segment where EVs are truly thriving, it’s three-wheelers—especially passenger autos at 34.3% penetration. Why? Economics, pure and simple.

Auto drivers are businesses on wheels. When Mahindra Last Mile Mobility delivers 96% electric autos (10,238 out of 10,661 units), it’s because these drivers have done the math: lower running costs equal higher profits.

TVS Motor achieved an impressive 51.1% EV share in passenger autos, while Bajaj leads the volume game with 43,798 total units (17.1% electric). For cargo autos, adoption sits at 16.8%—proving that commercial operators understand the total cost of ownership better than anyone.

Four-Wheeler Reality: The Holdouts and Champions

Here’s the uncomfortable truth: Maruti Suzuki, India’s car king with 2,38,875 units sold, has zero electric vehicles. Not one. Same story for Toyota, Honda, Renault, and Nissan—100% petrol and diesel.

But look at the disruptors:

- MG Motor India: Jaw-dropping 78.2% EV penetration (4,525 electric out of 5,786 total)

- Tata Motors: 9.6% electric with 7,157 EVs from 74,855 units

- Mahindra: 5.8% EV share with 3,877 units

- Mercedes-Benz: Even luxury is electric at 4.9%

The four-wheeler segment sits at just 3.2% overall EV penetration—up from 2.3% last year, but a slide from September’s 5.3%. India’s car buyers are cautious, and understandably so.

What’s Really Happening Here?

October’s numbers reveal three critical insights:

First, commercial vehicle operators are the real EV early adopters. When your livelihood depends on fuel costs, electric makes sense immediately.

Second, consumer vehicles lag because of the classic concerns: range anxiety, charging infrastructure, and upfront costs. A working-class family buying their first scooter will choose the cheaper petrol option every time.

Third, legacy automakers are playing it safe. Why would Maruti risk its dominant position by pushing expensive EVs when buyers want affordable Altos and Swifts?

The Bottom Line

India’s EV transition isn’t a revolution—it’s an evolution. Three-wheeler autos are leading the charge because the business case is bulletproof. Pure-play EV brands like Ather and Ola are creating their own lane. But the giants? They’re waiting for infrastructure, incentives, and customer confidence to align.

The October 2025 numbers don’t lie: 95.4% of two-wheelers, 96.8% of cars, and 65.7% of passenger autos are still powered by traditional engines. The future is electric, yes—but in India, that future is arriving one practical, calculated step at a time.