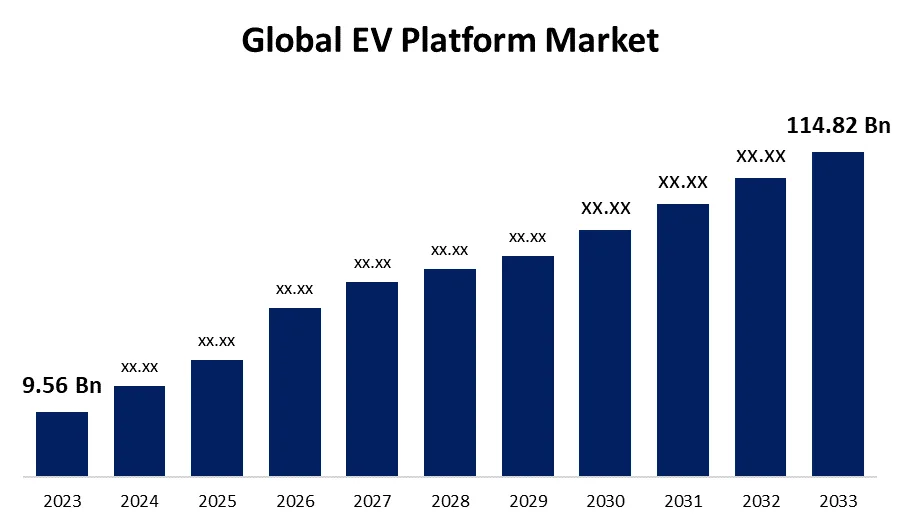

EV Market Growth, the electric vehicle revolution seemed unstoppable just months ago. But August 2025 brought a reality check that has industry analysts recalibrating their projections. While EVs are still selling in record numbers, the pace of growth is cooling—and the reasons why tell a fascinating story about where the market is headed.

Table of Contents

The Numbers Don’t Lie

August saw 1.8 million EVs sold globally, marking a 21.5% year-on-year increase. Impressive, right? Here’s the catch: growth has been slowing consistently since April, when deliveries surged 37.9%.

EV Growth: Then vs. Now

| Month | Year-on-Year Growth | Trend |

|---|---|---|

| April 2025 | 37.9% | Peak growth |

| May 2025 | ~25% | Declining |

| August 2025 | 21.5% | Continued slowdown |

| Jan-Aug Total | 31.2% (13M+ vehicles) | Still robust overall |

This isn’t a collapse—it’s a maturation. But what’s driving the deceleration?

The Tale of Two Powertrains

The slowdown story has two protagonists behaving very differently:

Battery-Electric Vehicles (BEVs) remain the star performer. In August, BEV sales increased by 27.4%, with 8.3 million units sold in the first eight months of 2025. The Tesla Model Y held its throne with over 105,000 units sold in August alone, maintaining a commanding 9% market share.

Plug-in Hybrids (PHEVs), however, tell a different story. After a 44.3% spike in May, PHEV growth dropped month after month, managing only 11.8% growth in August.

China: The Elephant in the Showroom

Here’s where it gets interesting. China accounts for 75.2% of all global PHEV sales, but its growth crawled at just 4.7% in August—the weakest performance since June 2020.

Meanwhile, other markets showed strength: US PHEV deliveries rose 24%, and Germany saw an impressive 77.7% increase. But these markets represent mere drops in the bucket—5.4% and 3.8% of the global PHEV market respectively.

When China sneezes, the global EV market catches a cold.

Winners and Losers on the Sales Floor

PHEV Models: The Struggle is Real

Established PHEV models faced headwinds in August. The BYD Qin Plus saw deliveries drop 18.1%, while the BYD Song Plus plummeted 36.8%. The worst performer? The BYD Qin L, which crashed 65% to 12,600 units.

What’s happening? Newer, more advanced vehicles are eating into market share. The fresh-faced BYD Sealion 06, first sold in June 2025, immediately grabbed 2.4% of the market with 15,019 units.

BEV Models: Tesla’s Resilience

The Tesla Model Y increased deliveries by 7.8% to 105,904 units, marking three consecutive months of improvement after a rocky start to 2025.

The Xiaomi SU7 emerged as the growth champion, jumping 51.3% with 19,877 deliveries. Chinese tech companies aren’t just making phones anymore—they’re seriously disrupting the auto industry.

Not everyone celebrated. The BYD Yuan Plus (Atto 3) nosedived 43.7% to 18,683 units, dropping its market share from 3.6% to 1.6%.

What This Means for the Future

For Consumers: Expect aggressive pricing as manufacturers battle for market share. New entrants like Xiaomi and Geely are forcing established players to innovate or discount.

For Investors: The PHEV slowdown signals a market decision—buyers want full electric or nothing. The transitional technology phase may be ending faster than anticipated.

For Policy Makers: Europe’s upcoming incentive changes could provide September’s numbers with a boost, but they won’t reverse the fundamental trend: China’s massive market drives global statistics.

The Bigger Picture

This slowdown isn’t necessarily bad news. It reflects market maturation—early adopters have bought their EVs, and now manufacturers must convince the mainstream. That requires:

- Better charging infrastructure (more urgent than ever)

- Competitive pricing (BYD’s dominance in multiple segments proves affordability matters)

- Extended range (still a barrier for many buyers)

- Model diversity (one size doesn’t fit all)

With over 13 million EVs sold between January and August—a 31.2% increase—the revolution continues. It’s just evolving from explosive growth to sustainable expansion.

Bottom Line

The EV market isn’t stalling—it’s shifting gears. BEVs are accelerating while PHEVs pump the brakes. Tesla maintains its grip while Chinese newcomers crowd the podium. And as always, China’s choices echo across the entire industry.

The question isn’t whether EVs will dominate the future. It’s how quickly that future arrives, and which manufacturers will still be racing when it does.