Remember when General Motors promised a future with “no more gas, no more diesel, no more carbon emissions” by 2030? That bold 2017 vision now feels like a distant dream as America’s electric vehicle revolution hits unexpected speed bumps.

Table of Contents

The Dream vs. The Reality

Back in the late 2010s, automakers were racing to electrify. GM led the charge, Ford pledged to triple Electric Vehicle investments, and the future looked bright. Fast forward to 2025, and we’re witnessing something nobody predicted: a dramatic slowdown in US EV adoption that’s costing billions and reshaping the industry.

General Motors just announced a staggering $1.6 billion loss as it scales back Electric Vehicle operations. The message is clear—the American EV market isn’t evolving as planned.

What Killed the Momentum?

The Subsidy Shakeup

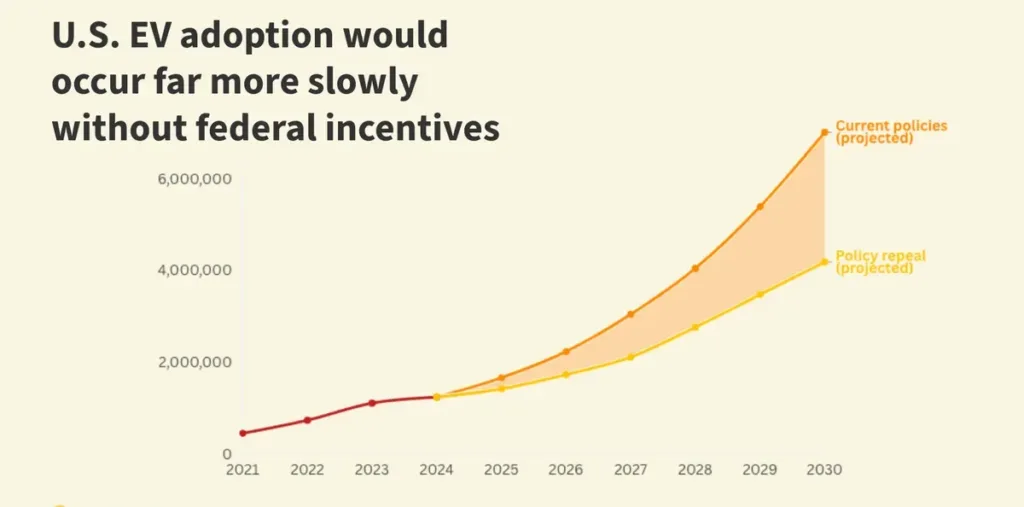

September 30, 2024, marked a turning point. The federal $7,500 EV tax credit—a lifeline for buyers since 2008—expired under new administration policies. The impact was immediate and brutal.

Before the expiry, Americans rushed to dealerships, pushing third-quarter EV sales up 40%. But this surge masked deeper problems. The second quarter had seen sales drop 6.3% year-over-year, revealing what industry insiders call “EV fatigue.”

The Price Problem Nobody’s Talking About

Here’s the real story: It’s not just about range anxiety or charging stations—it’s about dollars and cents.

| Vehicle Type | Average Price |

|---|---|

| New Traditional Car | $50,000+ |

| New Electric Vehicle | $57,000 |

| Used Electric Vehicle | $30,000 |

| Used Gas-Powered Car | $30,000 |

Notice something? Used Electric Vehicles now cost the same as used gas cars, while new EVs command a $7,000 premium without subsidies. Savvy buyers are choosing used Electric Vehicles over new ones, gutting profit margins for manufacturers.

The Ripple Effect Across Industries

The slowdown isn’t confined to showrooms. In Quebec, GM and POSCO paused expansion of their $600 million battery facility. Brazilian mining giant Vale scrapped plans for a nickel sulfate plant. The entire supply chain is feeling the chill.

Ford’s CEO predicts Electric Vehicle sales could plummet 50% post-subsidy. With Ford, GM, and Stellantis all bleeding money on electric models, the industry faces a reckoning.

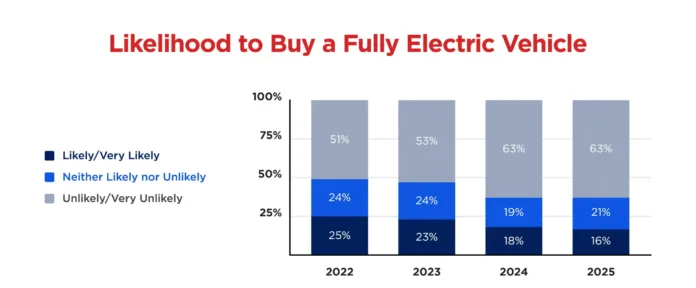

What Buyers Are Really Thinking

An August 2024 Edmunds survey revealed the top concerns stopping Electric Vehicle purchases:

- Finding charging stations

- Long charging times

- Vehicle availability and reliability

- Higher upfront costs

These aren’t trivial worries. RBC Capital Markets identifies insufficient public charging infrastructure—especially fast Level 3 chargers—as the main constraint on adoption.

The Global Divide

While America stalls, the world isn’t waiting.

China continues dominating with 1.3 million EV sales in September alone—more than half of global sales. Their secret? Lower battery production costs and penetration rates triple those of the US.

Europe maintains momentum through regulatory mandates requiring specific Electric Vehicle sales percentages, even as forecasts drop from 50% to 40% adoption.

The New Timeline

Industry forecasters have recalibrated expectations dramatically. The US won’t hit 50% Electric Vehicle adoption until 2039—five years later than previously predicted. RBC Capital Markets slashed its 2030 forecast in half, from 35% to just 17%.

BloombergNEF delivers even grimmer news: 14 million fewer Electric Vehicle could be sold by 2030 under current policies.

What This Means for You

If you’re considering an Electric Vehicle, the math has changed. Without federal incentives and with new car prices exceeding $50,000, the used Electric Vehicle market offers compelling value at $30,000. But infrastructure concerns remain valid—charging accessibility still lags far behind gas stations.

For the industry, this slowdown represents more than lost sales. It’s a fundamental reassessment of America’s electric future, one that prioritizes market realities over aspirational timelines.

The Electric Vehicle revolution isn’t dead—it’s just moving slower than anyone hoped. And in this new landscape, patience and pragmatism trump bold promises.