Australia’s electric vehicle revolution is roaring ahead—but there’s a catch. While EV sales skyrocketed 24% in 2025, one country is quietly powering the entire movement: China. And that’s sparking some serious conversations in Canberra.

Table of Contents

The Numbers Tell a Dramatic Story

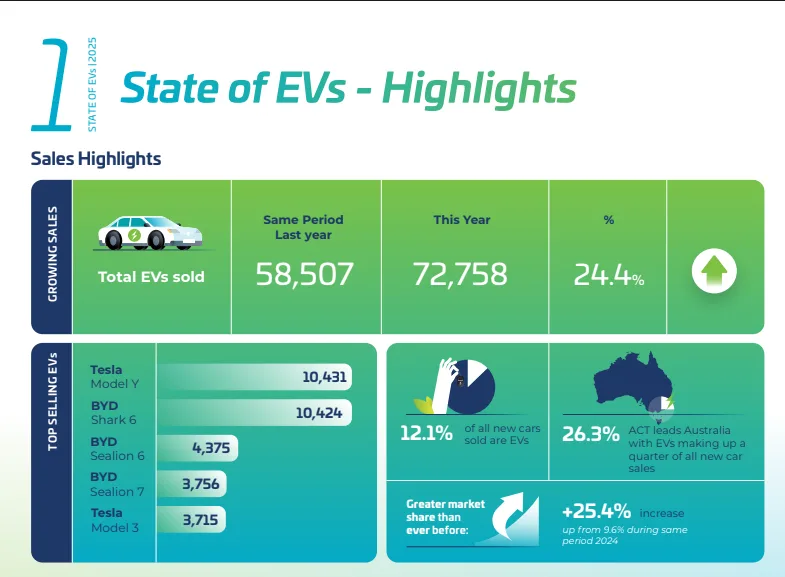

Australia’s love affair with electric vehicles hit new heights in the first half of 2025. The Electric Vehicle Council reports a stunning 72,758 EVs sold—a 24.4% jump from last year. Even more impressive? EVs captured 12.1% of all new car sales, with June hitting a record 16% market share.

Here’s where it gets interesting: China didn’t just participate in this boom—it dominated it.

| Key Metric | 2025 H1 Performance |

|---|---|

| Total EV Sales | 72,758 units (+24.4% YoY) |

| EV Market Share | 12.1% of new vehicle sales |

| Chinese EV Share | 77.5% of all battery EVs |

| Total EV Fleet | 410,000+ vehicles |

| Fleet Penetration | 2% of all vehicles on road |

The Dragon in the Room

Chinese automakers like BYD, MG, and Great Wall Motors aren’t just playing in Australia’s EV sandbox—they own it. A staggering 77.5% of every battery-electric vehicle sold in Australia this year came from China.

Why? Simple: they’re offering advanced features at prices that make European, American, and Japanese competitors look expensive. When your neighbor buys a feature-packed Chinese EV for thousands less than a Tesla or European alternative, the choice becomes obvious.

But here’s where the plot thickens.

When Cheap Becomes Concerning

Australia’s total EV fleet has exploded to over 410,000 vehicles—more than double the count from just two years ago. That’s fantastic for climate goals. Less fantastic? The growing dependency on a single nation for the technology driving the country’s green future.

The global context is sobering:

- Europe slapped tariffs up to 45% on Chinese EVs

- The United States effectively banned them over security concerns

- Australia is now joining WTO reform talks about oversupply issues

Trade Minister Don Farrell is reportedly eyeing potential anti-dumping measures. Translation: those affordable Chinese EVs might not stay affordable forever.

The Infrastructure Race

You can’t have an EV revolution without places to charge them. Australia gets this. The country now boasts 1,272 fast-charging locations with over 4,192 high-power public charging plugs.

State governments are going all-in:

- New South Wales: $199 million destination charging initiative covering up to 80% of installation costs

- Western Australia: Charge Up Program funding 50% of charging infrastructure expenses

- Federal Government: $40 million DRIVEN Program offering rebates for charging installations

These aren’t just climate initiatives—they’re creating commercial opportunities for property owners, shopping centers, hotels, and fleet operators. Smart businesses are positioning themselves as EV-friendly destinations.

The Trillion-Dollar Question

Here’s Australia’s dilemma: Chinese EVs made the electric revolution affordable. Without them, reaching the Climate Change Authority’s target of 50% EV market share by 2035 becomes significantly harder.

But experts warn that data security, supply chain continuity, and technology sovereignty are real concerns. What happens if:

- Spare parts become unavailable?

- Geopolitical tensions disrupt supply chains?

- Connected EV systems pose cybersecurity risks?

Dealer associations are already raising red flags about technician training, parts availability, and the risks of having Chinese software running Australia’s connected vehicle fleet.

What Happens Next?

Australia faces a delicate balancing act. The government must:

- Keep EVs affordable to meet emissions targets

- Reduce dependence on a single supplier nation

- Attract investment from Europe, South Korea, and Japan

- Build local assembly capacity

It’s like trying to pivot away from your biggest supplier while still needing them to keep prices low enough for mass adoption. Not exactly simple.

The Bottom Line

Australia’s EV market is booming, and Chinese manufacturers deserve credit for making electric mobility accessible. The 24% sales surge proves the strategy is working.

But as one analyst aptly noted: “Australia’s EV revolution runs on Chinese batteries—for now. The question is, for how long?”

With Europe and America already taking protective measures, Australia’s window for strategic diversification is shrinking. The next chapter of this story will determine whether Australia’s green transition remains affordable, secure, and sustainable—or becomes a cautionary tale about putting too many eggs in one basket.

The revolution is here. Now comes the hard part: managing it.