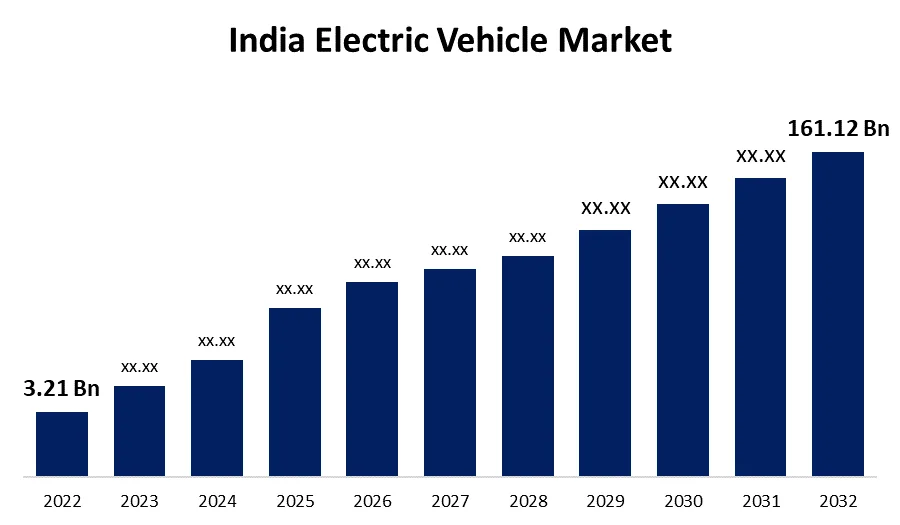

India’s electric vehicle revolution is accelerating faster than ever imagined. Picture this: a market that’s about to explode from millions to billions, transforming how we drive, power our homes, and think about energy independence.

The numbers tell a compelling story. India’s passenger EV market closed 2024 at nearly 99,000 units and is racing toward 140,000 units in 2025—almost entirely battery electric vehicles. By 2030? We’re looking at 700,000 units, representing 7-8% of total passenger vehicle sales.

But here’s where it gets really exciting: the battery management system market alone, valued at $278 million in 2024, is projected to skyrocket to $1.22 billion by 2033.

Table of Contents

The Driving Forces Behind India’s EV Surge

Three powerful trends are fueling this transformation:

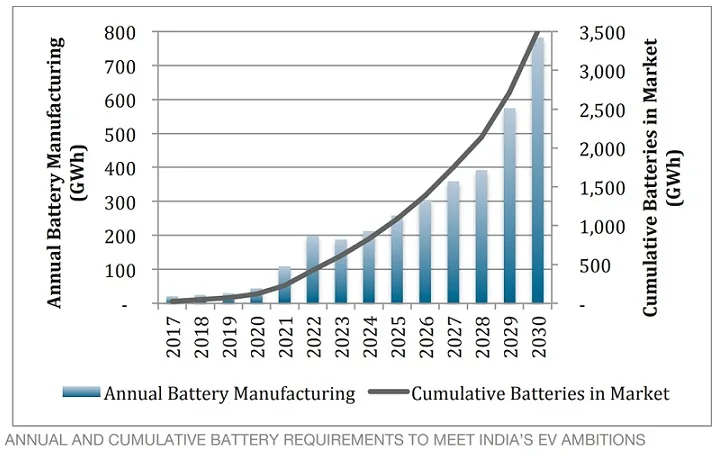

Supply chain localization is bringing manufacturing home. No longer dependent on imports, India is rapidly building its own technology base tailored to local conditions.

Cross-industry collaborations are breaking down silos. Traditional automakers, tech companies, and energy providers are joining forces to create integrated solutions.

Rapid technological advancements are making EVs more accessible. Battery Management Systems (BMS) are becoming crucial across electric vehicles and energy storage systems.

Market Leaders and Game Changers

| Segment | Key Players | Strategy |

|---|---|---|

| Mass Market | Tata Motors, Mahindra & Mahindra | Leading battery-electric segment |

| Premium Segment | Tesla, VinFast | Strengthening high-end offerings |

| Technology | Local innovators | Developing India-first products |

The Reality Check: Challenges Ahead

While the growth trajectory looks promising, experts are calling for strategic pivots. The next priority? Incentivizing recycling, particularly for LFP batteries, to ensure sustainability and economic viability.

Government programs like FAME and PLI have successfully catalyzed EV adoption and local cell production. But as one industry leader points out, “Local innovation suited to Indian conditions will be key to long-term self-reliance.”

Beyond Pure Electric: A Balanced Future

The future won’t be exclusively electric. Global trends point toward technology-agnostic powertrain strategies—a balanced mix of electric, hybrid, and range-extended vehicles. This pragmatic approach acknowledges diverse consumer needs and infrastructure realities.

Global Context: India’s Position

By the end of 2025, the global electric passenger car market is expected to reach about 21 million units. India’s 140,000 units might seem modest in comparison, but the growth rate tells a different story. From 99,000 to 700,000 units in just six years represents explosive expansion.

What This Means for You

Whether you’re an investor, entrepreneur, or consumer, India’s EV battery market presents unprecedented opportunities. The ecosystem is maturing rapidly, with 350+ exhibitors and 400+ brands showcasing cutting-edge technologies at industry events.

The convergence of policy support, technological innovation, and market demand is creating a perfect storm for growth. As India builds its clean energy future, the battery sector stands at the epicenter of this transformation—powering not just vehicles, but an entire nation’s sustainable ambitions.