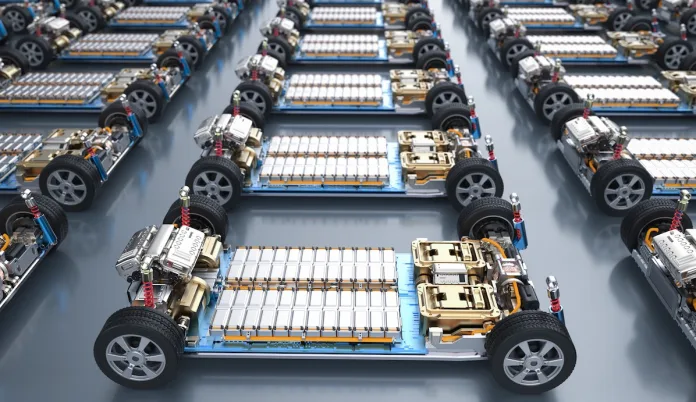

The EV Battery revolution is creating an unexpected treasure trove hiding in plain sight. As millions of EVs hit the road worldwide, a parallel industry is experiencing explosive growth that could transform how we think about waste, sustainability, and critical materials. The EV battery recycling market isn’t just growing – it’s skyrocketing at an astounding 32% annual growth rate.

Table of Contents

The Numbers That Tell an Extraordinary Story

According to Mordor Intelligence, the global electric vehicle battery recycling market is valued at USD 3.88 billion in 2025 and is projected to reach USD 15.58 billion by 2030, growing at a CAGR of 32.05% during the forecast period.

This isn’t just another market statistic – it represents a fundamental shift from waste to wealth, where yesterday’s discarded batteries become tomorrow’s critical resource supply.

The Perfect Storm Driving Unprecedented Growth

Four powerful forces are converging to create this recycling revolution, transforming what was once an environmental burden into a strategic economic opportunity.

1. The First Wave of EV Battery Retirement

The first generation of electric vehicles is reaching the end of their battery life cycles, creating a surge in available recycling material. Since used battery packs contain richer metal concentrations than traditional mining sources, recyclers can achieve better profit margins while processing volumes that early-adoption markets are feeling first.

2. Government Mandates Tightening the Recycling Loop

Stricter recycling mandates are emerging globally, requiring automakers to ensure materials are recovered and reused. These regulations guarantee steady supply streams for recyclers, improve facility utilization rates, and transform recycling from a voluntary practice into a regulated necessity.

3. Critical Material Price Volatility

Even with recent market adjustments, lithium and cobalt prices remain significantly above historical levels. Recycling offers manufacturers a cheaper, more stable alternative to mining while reducing exposure to geopolitical supply risks that can disrupt traditional sourcing.

4. Automaker Supply Chain Revolution

Leading automotive companies are closing the loop by partnering directly with recyclers to reduce emissions and localize sourcing. These strategic agreements guarantee demand for recycling services while supporting rapid scaling of technologies optimized for specific battery chemistries.

Market Breakdown: Where the Value Lives

By Battery Chemistry:

| Battery Type | Key Metals | Market Share Trend |

|---|---|---|

| Lithium-ion (NMC/NCA) | Nickel, Cobalt, Lithium | Dominant segment |

| Lithium Iron Phosphate | Lithium, Iron | Fastest growing |

| Nickel-Metal Hydride | Nickel, Rare Earth | Legacy hybrid vehicles |

By Recovered Materials:

- Lithium: Highest value density, critical supply shortage

- Cobalt: Geopolitically sensitive, premium pricing

- Nickel: High volume, stable demand

- Manganese: Growing importance in new chemistries

Regional Powerhouses Leading the Charge

Europe: The Regulatory Pioneer

Europe leads global markets through strict EU battery waste regulations. Advanced facilities in Germany, France, and Nordic countries achieve industry-leading recovery rates, setting global standards for efficiency and environmental compliance.

Asia Pacific: Scale and Innovation Hub

Asia Pacific dominates recycling capacity, led by China’s massive infrastructure investments and strong policy support. Japan, South Korea, and India are expanding rapidly with innovative processing technologies that improve both yield and cost-effectiveness.

North America: Strategic Independence Focus

North America is advancing quickly with significant investments in large-scale plants. The US and Canada prioritize secure access to critical minerals through supportive policies and strategic OEM-recycler partnerships.

The Technology Revolution Behind the Numbers

Modern recycling processes have evolved far beyond simple material recovery. Three primary approaches are competing for market dominance:

Process Comparison:

| Method | Recovery Rate | Energy Use | Material Purity |

|---|---|---|---|

| Hydrometallurgical | 95%+ | Medium | Highest |

| Pyrometallurgical | 85-90% | High | High |

| Direct/Mechanical | 80-85% | Low | Variable |

Industry Giants Staking Their Claims

The market features an impressive roster of established players and innovative newcomers positioning for growth. Companies like Redwood Materials, Li-Cycle, and Umicore are leading technological advancement, while traditional players like Glencore and Veolia leverage existing infrastructure advantages.

These industry leaders are investing billions in capacity expansion, process optimization, and strategic partnerships that will define market structure through 2030.

The Circular Economy Transformation

This growth represents more than market expansion – it’s the emergence of a true circular economy for critical materials. Instead of the traditional linear model of mine-manufacture-dispose, we’re witnessing the birth of mine-manufacture-recycle-remanufacture cycles that could fundamentally alter global supply chains.

Economic Impact Beyond Recycling:

- Job Creation: High-skilled manufacturing and engineering positions

- Supply Security: Reduced dependence on unstable mining regions

- Cost Reduction: Lower material costs for EV manufacturers

- Environmental Benefits: Dramatically reduced mining environmental impact

Future Outlook: Beyond the 32% Growth Rate

The 32% growth rate represents just the beginning of this transformation. As EV adoption accelerates globally, the volume of end-of-life batteries will increase exponentially. Current projections suggest that by 2030, recycled materials could supply 20-30% of total battery material demand.

This shift has profound implications for everyone from individual EV owners to global automotive manufacturers. The “waste” batteries sitting in garages today could become the strategic resources powering tomorrow’s clean transportation revolution.

Conclusion: The Green Gold Rush Has Begun

The EV battery recycling market’s explosive 32% growth rate signals more than just another successful industry – it represents the maturation of sustainable technology cycles. As we transition from the first generation of EVs to the second, the materials that powered our initial electric dreams are becoming the foundation for an even more sustainable automotive future.

For investors, manufacturers, and environmentally conscious consumers, this isn’t just a market trend to watch – it’s a fundamental shift that will define how we power transportation for decades to come.