The Indian electric vehicle sector just witnessed a seismic shift. A domestic EV company has secured approval for manufacturing 100% ‘Make in India’ electric vehicles, sending shockwaves through the stock market and delivering astronomical returns that have investors scrambling for attention.

Table of Contents

The Numbers That Stunned Markets

According to BSE Analytics, the stock has delivered a multibagger return of 8522 per cent in five years and 473 per cent in three years. These aren’t just impressive numbers—they represent the kind of transformative growth that defines entire market cycles.

India’s EV Revolution: More Than Just Hype

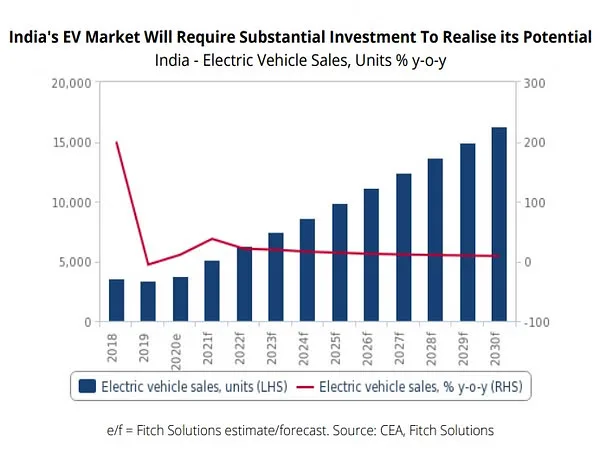

The manufacturing approval comes at a crucial time for India’s electric vehicle industry. EV sales grew by 16.9% in FY25 to 1.97 million units, up from 1.75 million in FY24. This isn’t just growth—it’s the foundation of India’s automotive transformation.

Indian automakers will launch nearly a dozen new EVs in 2025, focusing on premium models, as India’s EV sales rose 20% despite slowing global demand, with a 30% target by 2030.

Government Support: The Game-Changing Factor

The Indian government’s commitment to electric mobility has created unprecedented opportunities. Applications are open from June 24, 2025, until October 21, 2025. The scheme was initially notified on March 15, 2024, with detailed guidelines issued on June 2, 2025. It aims to attract global investment in EV manufacturing, reinforce the Make in India and Aatmanirbhar Bharat missions.

Additionally, the Indian government extended basic customs duty exemptions in the Union Budget 2025 to 35 additional capital goods essential for EV battery production, creating a more favorable manufacturing ecosystem.

Top Indian EV Stocks to Watch in 2025

| Company | Sector Focus | Market Position | Key Advantage |

|---|---|---|---|

| Tata Motors | Passenger EVs | Market Leader | Established ecosystem |

| Mahindra & Mahindra | Electric SUVs | Strong Portfolio | Three-wheeler expertise |

| Bajaj Auto | Two & Three-wheelers | Export Focus | Global presence |

| Amara Raja Batteries | EV Batteries | Component Leader | Battery technology |

| Exide Industries | Battery Solutions | Manufacturing Base | Infrastructure ready |

The Manufacturing Approval Impact

This latest approval represents more than just another company entering the EV space. It signifies India’s transition from being an import-dependent market to becoming a self-reliant manufacturing hub. The ‘Make in India’ certification ensures:

- Complete domestic production reducing import dependencies

- Job creation in the green mobility sector

- Technology transfer and skill development

- Export potential to global markets

Why This Matters for Investors

The astronomical returns of 8522% over five years aren’t coincidental—they reflect India’s structural shift toward electric mobility. Several factors are driving this transformation:

Policy Support: Government incentives, subsidies, and manufacturing schemes create a favorable investment environment.

Market Demand: Rising fuel costs and environmental consciousness are driving consumer adoption.

Infrastructure Development: Expanding charging networks reduce range anxiety.

Technology Advancement: Battery costs falling and ranges improving.

The Road Ahead: Opportunities and Challenges

While the growth story is compelling, investors must consider both opportunities and risks. The Indian EV market faces infrastructure challenges, battery technology gaps, and intense competition. However, government support, rising consumer awareness, and technological progress create a favorable long-term outlook.

Investment Perspective: Beyond the Headlines

The recent manufacturing approval and subsequent stock surge highlight India’s EV sector potential. However, successful investing requires looking beyond headline numbers to understand business fundamentals, market dynamics, and long-term sustainability.

As India races toward its 2030 EV adoption targets, companies with manufacturing approvals, strong technology partnerships, and government support are positioned to benefit from this transformation. The question isn’t whether India’s EV revolution will continue—it’s which companies will lead it.