Global electric vehicle sales jumped nearly 30% in April 2025, led by China and Europe. Discover why the US is lagging and what this means for the EV market.

Table of Contents

Global EV Sales Surge 30% in April: Why the US Is Falling Behind

The electric vehicle (EV) revolution is accelerating at an unprecedented pace worldwide. In April 2025, global sales of electric and plug-in hybrid vehicles surged by nearly 30% compared to the same month last year.

This rapid growth highlights the increasing consumer shift toward greener transportation options. However, while China and Europe are leading this charge, the United States is noticeably falling behind. What factors are driving this divergence, and what does it mean for the future of the EV market globally?

A Closer Look at April 2025 EV Sales

In April 2025, approximately 1.5 million electric vehicles were sold worldwide. This figure represents a 29% increase compared to April 2024, although it is a 12% decrease from March 2025’s sales. When looking at the broader picture, from January to April 2025, global EV sales reached 5.6 million units, marking a significant 29% year-over-year increase.

| Region | Sales Growth Jan-Apr 2025 (YoY) | April 2025 Sales Growth (MoM) |

|---|---|---|

| China | +35% | +32% |

| Europe | +25% | +35% |

| North America | +5% | -5.6% |

| Rest of World | +37% | +51% |

China and Europe are the clear frontrunners in this global race, with Europe’s growth largely driven by stringent emissions regulations and ambitious climate targets. China’s government is aggressively promoting EV adoption through subsidies and incentives. Meanwhile, North America’s growth has slowed, impacted by political uncertainty and trade tariffs.

Why Is the US Lagging Behind?

The United States’ EV market is facing several significant challenges that are slowing its growth relative to China and Europe. One of the most critical factors is political uncertainty surrounding green policies and incentives.

Currently, American consumers can claim a tax credit of up to $7,500 (€6,679) for qualifying EV purchases, a policy introduced under President Biden’s administration to encourage clean energy adoption. However, this incentive is under threat.

Recent draft legislation proposed by Republicans aims to eliminate this tax credit by the end of 2026. Moreover, the draft suggests limiting eligibility to manufacturers that have sold fewer than 200,000 EVs by the end of 2025, potentially excluding major players like Tesla and General Motors. Tax incentives for commercial and second-hand EVs could also be scrapped.

This looming policy uncertainty is causing hesitation among consumers and investors alike, dampening the momentum of EV adoption in the US.

Another major hurdle is the tariffs imposed by former President Trump on imported cars and car parts, set at 25%. These tariffs increase costs for automakers operating global supply chains, squeezing profit margins and raising prices for consumers.

Although some relief measures have been introduced—such as an executive order to prevent “stacking” of tariffs on steel and aluminum—tariffs still pose a significant challenge.

Christian Brand, emeritus professor of transport, energy, and climate change at Oxford University, explains, “EV adoption is accelerating — but politics, not technology, will decide who leads and who lags.” The US’s political landscape, with its tariff policies and uncertain incentives, is currently a barrier to faster EV growth.

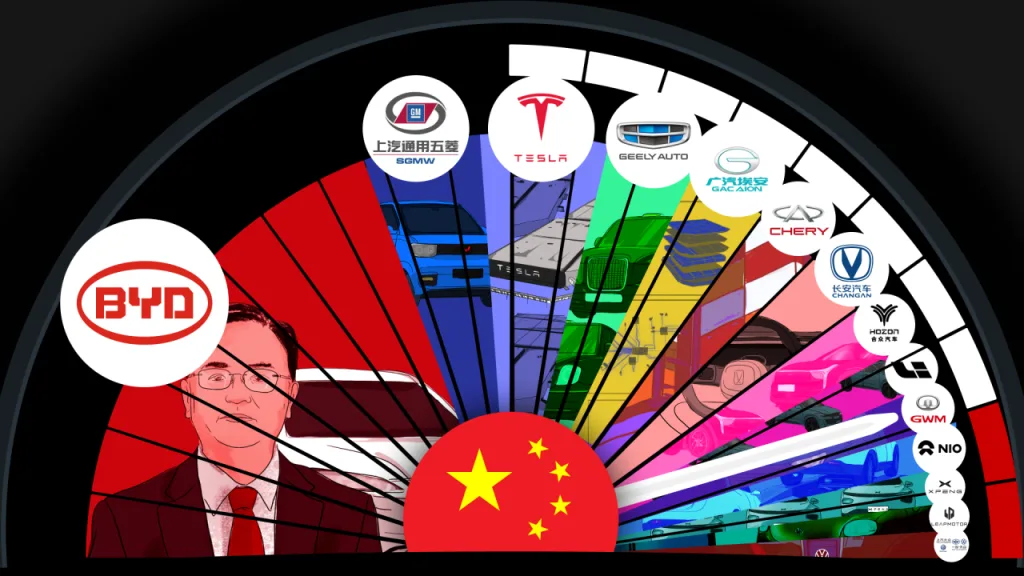

China’s Strategic Push to Lead the EV Market

China’s government is taking a proactive approach to boost EV sales as part of a broader strategy to stimulate its economy, which has been weighed down by a property crisis, geopolitical tensions, and weak consumer confidence.

To encourage consumers to switch to electric or hybrid vehicles, China offers subsidies of up to 20,000 yuan (€2,471) for trading in old cars for new EVs. This financial incentive, combined with a growing network of charging infrastructure and strong domestic EV manufacturers, has helped China maintain its position as the world’s largest EV market.

China’s focus on EVs is not just about environmental benefits; it’s also a strategic economic move to dominate the future of automotive technology and manufacturing.

Europe’s Success Story: Policy-Driven Growth

Europe’s EV market is thriving, with sales up 25% year-over-year from January to April 2025 and a remarkable 35% growth in April alone. This success is largely attributed to the European Union’s aggressive emissions targets, which have pushed automakers to accelerate their transition to electric vehicles.

The EU’s regulatory framework includes strict CO2 emissions limits for new cars, which effectively forces manufacturers to increase their EV offerings or face heavy fines. This regulatory pressure has created a fertile environment for EV innovation and adoption.

Additionally, many European countries offer generous incentives, such as purchase subsidies, tax breaks, and exemptions from congestion charges, further encouraging consumers to choose electric.

The Bigger Picture: Politics, Policy, and Market Dynamics

The global EV market is not just about technology; it’s deeply intertwined with politics, trade policies, and consumer confidence. The table below summarizes the key factors shaping EV market growth across regions:

| Key Factors Influencing EV Market Growth | Impact on Regions |

|---|---|

| Government Incentives | Boost sales in China and Europe |

| Tariffs and Trade Policies | Slow growth in the US |

| Consumer Confidence | Higher in China and Europe |

| Emissions Regulations | Drive innovation and adoption in EU |

| Supply Chain Challenges | Affect global automakers |

Europe and China’s clear and consistent policies have created an environment where EV adoption can flourish. In contrast, the US faces a complex landscape of political uncertainty and trade barriers that hinder its EV market growth.

What Does the Future Hold for EVs?

Despite the challenges, the global trend toward electric vehicles is undeniable. The International Energy Agency projects that more than one in four cars sold worldwide in 2025 will be electric. However, the pace of adoption will vary significantly by region, largely depending on government policies and market conditions.

Christian Brand emphasizes that the shift to EVs is a “gradual evolution rather than a swift revolution.” The transition involves reconfiguring entire value chains, including manufacturing, maintenance, and charging infrastructure. Businesses must adapt to evolving regulations, supply chain complexities, and changing consumer expectations to stay competitive.

Conclusion

The global electric vehicle market is rapidly expanding, with China and Europe leading the way thanks to strong government support and clear policies.

The United States, meanwhile, faces political and economic challenges that threaten to slow its EV momentum. As the world moves toward a cleaner, more sustainable future, the winners will be those who combine innovation with consistent, supportive policy frameworks.

The EV revolution is not just about changing cars—it’s about transforming how we live, work, and move. Stay informed and engaged as this exciting journey unfolds.