Global sales for EV reached a remarkable milestone in February 2025, with 1.2 million units sold worldwide. This significant achievement represents a 49% increase compared to the same period last year, highlighting the rapid transformation of the automotive industry. The electric vehicle market growth continues to exceed expectations, driven by technological advancements, expanding charging infrastructure, and supportive government policies.

The latest electric vehicle adoption trends demonstrate a clear shift in consumer preferences toward sustainable transportation. Notably, this surge in electric vehicle sales spans across major markets, from China’s robust demand to Europe’s accelerating transition and North America’s growing acceptance. These statistics not only reflect the current state of the industry but also signal a fundamental change in how people view and purchase vehicles worldwide.

Record-Breaking Global EV Sales: 1.2M Units in February 2025

February’s Milestone Achievement

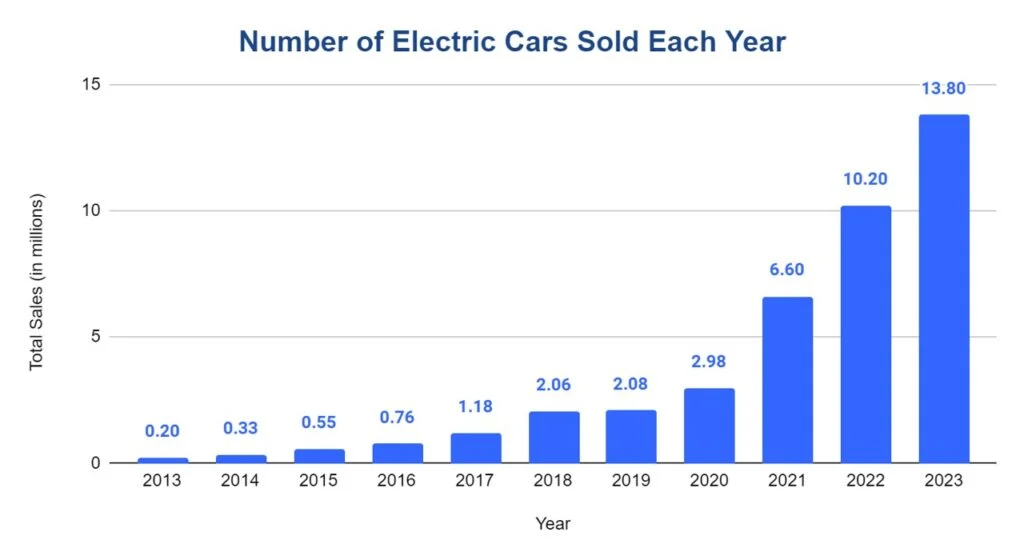

The electric vehicle market reached an unprecedented milestone in February 2025, with worldwide sales totaling 1.2 million units. This figure represents the highest February sales volume ever recorded for electric vehicles. Battery-powered electric vehicles dominated the market with 814,000 units, while plug-in hybrids accounted for 403,000 units. This achievement is particularly significant considering that in 2013, just a decade earlier, annual EV sales barely matched what is now being sold in a single week.

Data from Rho Motion indicates the global market witnessed a slight 3% decline from January 2025, yet maintained strong momentum. Furthermore, while conventional internal combustion engine vehicle sales fell by approximately 8% year-over-year, the EV sector continued its upward trajectory. This divergence highlights the fundamental shift occurring within the automotive industry as consumers increasingly transition to electric options.

Year-over-Year Growth Analysis

Electric vehicle sales surged by approximately 49% compared to February 2024 4. This substantial growth varied significantly across regions. China led with an extraordinary 76% year-over-year increase 1, solidifying its position as the dominant market with three-quarters of global sales for electric vehicles occurring within its borders 1.

The European market grew by 20% year-to-date, with battery electric vehicles experiencing a remarkable 29% increase despite Tesla’s 43% delivery decline in the region 2. North American sales similarly increased by 20%, with the United States specifically seeing a 28% rise in battery electric vehicle sales 4.

Additionally, emerging markets demonstrated impressive growth rates, with Indonesia (+205%), Vietnam (+220%), and Singapore experiencing substantial increases 2. Singapore has already achieved a 42% electric vehicle market share in 2025, potentially becoming the second fully electrified automotive market after Norway before the decade ends 2.

Key Market Drivers

Several factors are propelling the accelerated adoption of electric vehicles globally:

- Policy Support: Government initiatives like tax credits, purchase subsidies, and emissions regulations continue driving market growth. In China, following the end of national subsidies, many cities have established their own purchase subsidy schemes to maintain momentum 5.

- Expanding Model Availability: Mainstream manufacturers beyond Tesla are introducing competitive electric vehicles offerings across price segments. Luxury brands performed particularly well in February, with BMW and Rivian each selling over 4,000 units, representing increases of 20.9% and 34.0% respectively 5.

- Improved Battery Technology: Advancements have increased range capabilities while simultaneously reducing costs. Lithium-ion battery prices have fallen due to increased production capacity and technological innovations 6.

- Charging Infrastructure Growth: The expanding network of charging stations addresses range anxiety, with significant investments continuing in public charging infrastructure development 3.

- Shifting Consumer Preferences: Environmental awareness and lower operating costs are attracting more buyers to electric vehicles. The electric vehicle market now represents 19% of the overall automotive market globally (13% BEV share alone) 2.

The significant progress observed in February 2025 reinforces projections that global sales for electric vehicles could reach approximately 17 million units by the end of 2025 3, maintaining over 20% growth for a maturing market and capturing more than one-fifth of total car sales worldwide.

Regional Market Performance

China’s Dominant Position

The global electric vehicle landscape reveals pronounced regional disparities in adoption rates and market penetration. China maintains unrivaled dominance, accounting for nearly 60% of new electric car registrations worldwide in 2023 7. The Chinese market reached an impressive 8.1 million new electric vehicle registrations that year, representing a 35% increase compared to 2022 7. This growth occurred despite the elimination of national purchase subsidies, indicating a mature market driven increasingly by consumer preference rather than government incentives.

Chinese manufacturers have capitalized on their domestic advantage, with BYD surpassing Tesla in 2023 to become the world’s leading battery electric car maker, capturing 18% of the global market 5. Indeed, Chinese brands now dominate their home market—51% of all vehicles sold in China by July 2024 were either battery electric or plug-in hybrid 5.

European Market Dynamics

Europe has established itself as the second-largest electric vehicle market globally, representing approximately 25% of worldwide electric car sales in 2023 7. The continent recorded nearly 3.2 million new electric vehicle registrations that year, marking a 20% increase over 2022 figures 7. Within the European Union specifically, registrations reached 2.4 million units 7.

Nonetheless, adoption rates vary considerably across European countries. Sweden led with electric vehicles comprising 60% of new car sales, followed by the Netherlands at 30%, while France and the United Kingdom each approached 25% 7. Germany, although recording half a million new battery electric cars in 2023, saw its growth slow following the phase-out of purchase subsidies 7.

North American Electric Vehicle Adoption

North America represented approximately 10% of global electric car sales in 2023 7. The United States marked a significant milestone, exceeding 1 million units sold for the first time and reaching 1.4 million new registrations—a 40% increase from the previous year 7. Battery electric vehicles dominated this growth, accounting for 80% of EV sales in the region 5.

Looking forward, the North American electric vehicle market is projected to generate revenue of USD 138.7 billion in 2025 and grow at an annual rate of 12.02% through 2029 8. By the end of this period, unit sales are expected to reach 2.59 million vehicles 8.

Emerging Markets Growth

Eventually, emerging economies have begun showing promising signs of electric vehicle adoption. India’s electric car market grew by 70% year-on-year in 2023, reaching 80,000 registrations 7. Thailand experienced even more dramatic growth, with electric vehicle registrations quadrupling to nearly 90,000 units and achieving a 10% market share—comparable to the United States 7.

Latin American markets are likewise gaining momentum, with total electric car sales reaching almost 90,000 in 2023 7. Brazil led this regional growth with more than 50,000 registrations, nearly triple its previous year’s figure 7. Malaysia showed similar enthusiasm, with electric vehicle registrations more than tripling to 10,000 units 7.

The World Bank has recognized this potential, actively supporting countries in their transition to electric mobility through investments in infrastructure, technical assistance, and private sector engagement 9. These efforts primarily focus on public transport and e-busses, addressing the unique mobility needs of developing markets.

Top-Performing EV Manufacturers

The electric vehicle market hierarchy has witnessed significant reshuffling as established manufacturers and emerging players compete for dominance across global markets.

Leading Brands by Volume

Chinese manufacturer BYD has established itself as the worldwide leader in electric vehicle sales, delivering nearly 4.1 million plug-in electric vehicles globally 10. In September alone, BYD achieved a record-breaking 399,442 registrations 2. Tesla maintains second position with approximately 1.79 million units 10, though its performance fluctuates considerably—dropping 11% in August before rebounding with a 24% increase in September to 191,430 units 2.

Wuling secured third place with 68,605 registrations, followed by Li Auto with 55,602 units and Geely with 53,358 deliveries 2. Volkswagen performed strongly with 44,434 registrations, recording its best result of 2024 2. Among American manufacturers, General Motors reported a 50% increase in electric vehicle sales year-over-year, while Ford achieved 38% growth 11.

Market Share Shifts

The competitive landscape continues evolving rapidly. BYD currently commands 23.4% of the global electric vehicle market (including plug-in hybrids), up from 21.9% a year earlier 12. Tesla’s overall electric vehicle market share has declined to 11% from 14% during the same period 12. However, when considering only battery electric vehicles, Tesla still leads with 17.5% market share, though this represents a drop from 20.1% in 2022 12.

Within the U.S. market, Tesla’s dominance has eroded to 44% 11. Chinese brands have meanwhile made substantial inroads in European markets, increasing their collective share from 5% in 2015 to approximately 15% by 2023 3.

The global BEV portfolio demonstrates intense fragmentation, with the top ten manufacturers accounting for 65% of the overall market 6. Between them, BYD and Tesla represent more than a third of all electric car sales worldwide, exceeding the combined share of all major non-Chinese carmakers 3.

New Model Impacts

Model-specific performance has significantly influenced manufacturer standings. The Tesla Model Y stands as the world’s best-selling vehicle across all categories, including internal combustion engine vehicles 13. Meanwhile, BYD’s Song PHEV ranks as the second-best-selling electric vehicle globally 13.

Several new entrants have reshuffled brand hierarchy. BYD’s newcomers—Dolphin, Yuan Plus, and Seagull—have experienced exceptional market reception 14. Honda’s Prolog achieved remarkable success, accumulating over 33,000 sales in its first year 11. Legacy manufacturers have strengthened their positions through new models, with Chevrolet’s Equinox EV, Hyundai’s IONIQ 5, and Kia’s EV9 attracting substantial consumer interest 11.

Electric Vehicle Market Trends and Insights

Technological breakthroughs and supportive policies continue to accelerate the transformation of the global electric vehicle landscape in 2025, with several key developments shaping market dynamics.

Battery Technology Advancements

Lithium iron phosphate (LFP) batteries have emerged as a dominant force in the electric vehicle industry, supplying more than 40% of global EV demand by capacity in 2023—double their share from 2020 15. This chemistry offers significant cost advantages despite 30-60% lower energy density than nickel-manganese-cobalt alternatives 16. Battery pack prices fell by approximately 14% between 2022 and 2023, reversing the previous year’s 7% increase 15.

The first commercial solid-state batteries entered production in China’s IM Motors L6 sedan, promising ranges exceeding 400 miles. Toyota, QuantumScape, and Solid Power are advancing similar technologies for near-term deployment. Concurrently, sodium-ion batteries are gaining attention as they can be produced using existing manufacturing lines without requiring critical minerals like lithium 15.

Charging Infrastructure Expansion

Public charging networks have grown substantially, with over 61,000 stations now operating in the United States—more than double the number available in 2020 17. First-quarter 2024 data shows charging ports increased by 4.6%, with DC fast charging expanding at the highest rate (8.2%) 18. Presently, about 60% of Americans live within two miles of a public charger.

Battery swapping technology has gained significant traction, primarily in China where half of electric heavy-duty trucks sold in 2023 featured swapping capability. This approach offers five-minute battery exchanges and reduced grid pressure. Accordingly, companies in India like Sun Mobility and Battery Smart raised $50 million and $33 million respectively for swapping infrastructure.

Policy and Incentive Effects

Government policies remain instrumental in driving electric vehicle adoption across markets. Research examining European markets from 2012-2021 confirms that purchase incentives significantly increased battery electric vehicle registrations, with effects proving more substantial and longer-lasting than for plug-in hybrids 21. Conversely, ownership incentives showed limited impact on registration numbers 21.

The U.S. Inflation Reduction Act established new tax credit qualifications that boosted sales in 2023, with Tesla Model Y registrations increasing 50% after becoming eligible for the full $7,500 credit 1. Essentially, these developments demonstrate how technological innovation and policy frameworks continue shaping the electric mobility transition worldwide.

Future Outlook for Global Sales

As momentum builds in the electric vehicle sector, industry analysts project substantial growth across both immediate and extended timeframes, coupled with significant challenges that will shape market evolution.

Short-term Projections

Electric vehicle sales trajectory remains robust through 2025, with forecasts indicating total global sales will reach approximately 17 million units in 2024 4. This represents over 20% growth compared to 2023 figures 1. Subsequently, the electric vehicle market share is expected to surpass 20% of total car sales worldwide 4.

The International Energy Agency anticipates that first-quarter 2024 growth will maintain around 25% year-over-year 1. For 2025, the global electric vehicle market revenue is projected to reach USD 784.20 billion 22. China will likely continue its market leadership, generating an estimated USD 377 billion in 2025 22. According to Charles Lester from Rho Motion, despite European Union tariffs on Chinese EVs, there was “no clear downturn in sales” of major Chinese-made models 23.

Long-term Market Potential

Forecasts through 2030 and beyond reveal accelerating market transformation. Worldwide EV share of light-vehicle sales is expected to reach 22.6% by 2025, then surge to 44.6% by 2030 and 69.5% by 2035. In absolute terms, the global electric vehicle stock could approach 250 million vehicles by 2030 and grow to 525 million by 2035. For perspective, initially, Bloomberg projected 1.3 billion EVs replacing internal combustion engine vehicles by 2040—compared to fewer than 50 million currently in use globally. In the United States specifically, electric vehicles could capture 13.5% market share of light-vehicle sales by 2025, rising to 39.7% by 2030 and 71.8% by 2035.

Industry Challenges

Notwithstanding promising growth forecasts, several obstacles could hinder the electric vehicle market’s expansion. Primarily, infrastructure limitations persist—the gap between electric vehicle adoption and charging station availability continues to widen 25. Raw material supply constraints for critical battery components like lithium and cobalt have created price volatility and geopolitical tensions that threaten production stability 25.

Furthermore, policy uncertainty presents significant risks, as demonstrated by Germany’s market decline following abrupt subsidy removals 25. In the United States, concerns about potential changes under the incoming Trump administration could affect Inflation Reduction Act benefits 5. Finally, affordability remains problematic—in 2022, the average cost of most available EVs reached USD 65,000 (before tax credits), approximately 9% higher than in 2021 and considerably more expensive than the USD 44,600 average for non-luxury conventional vehicles 26.

Conclusion

Electric vehicle adoption has certainly reached a pivotal moment, marked by February 2024’s milestone of 1.2 million units sold globally. Market data demonstrates robust growth across major regions, with China leading at 76% year-over-year growth while European and North American markets show steady 20% increases. These figures highlight the automotive industry’s rapid shift toward electrification.

Battery technology advances and expanding charging networks have addressed many early adoption concerns. The falling battery pack prices, coupled with innovations like solid-state batteries, signal stronger market competitiveness for electric vehicles. Chinese manufacturers, particularly BYD, have established clear market leadership, though competition remains fierce across all segments.

Looking ahead, projections suggest global sales will reach 17 million units by 2025, representing over 20% of total car sales worldwide. The market faces notable challenges, including charging infrastructure limitations and raw material supply constraints. Above all, the industry’s trajectory points toward sustained growth, with EVs expected to capture nearly 70% of light-vehicle sales by 2035, reshaping the future of global transportation.

Also Read: Top 5 BMW EVs in 2025: The World of Luxury EVs

Frequently Asked Questions

How do EVs perform in cold weather?

Cold weather can reduce an EV’s range by 20-30% in extremely cold conditions. When tested at 38°F, using the heater set to 72°F increased energy consumption by approximately 17%, while maximum heat settings (including heated seats) increased consumption by 35%. This difference can translate to about 60 miles of lost range in some models.

Are EV batteries recyclable?

Yes. EV battery minerals can be recycled almost indefinitely without losing power. Many U.S.-based lithium-ion recycling companies report material recovery rates of 95-98%. Companies like Lithion Recycling in Quebec are building dedicated recycling plants. Before recycling, batteries often have second lives, storing power for electric grids.

What tax credits are available for EV purchases?

New EVs qualify for up to $7,500 in federal tax credits, subject to price and income caps. Used EVs can receive up to $4,000 in credits when purchased from dealers. Additionally, 30% of home charging equipment and installation costs (up to $1,000) are eligible for tax credits. Some manufacturers offer equivalent discounts when their vehicles don’t qualify for government incentives.

How long does charging typically take?

Charging times vary by equipment level. Level 1 (standard 120V outlet) is extremely slow and can take days for a full charge. Level 2 chargers (240V) typically require 8+ hours for a complete charge, making them ideal for overnight use. Level 3 DC fast chargers can deliver substantial range in 30-45 minutes, though charging speed decreases significantly above 80% capacity.

Do EVs really produce fewer emissions when considering manufacturing?

Studies show EVs reduce greenhouse gas emissions compared to gasoline vehicles, even accounting for manufacturing. One study found EVs can reduce emissions intensity by 41% even in areas where electricity comes from fossil fuels. The average EV makes up for its higher production environmental cost within the first few years of ownership