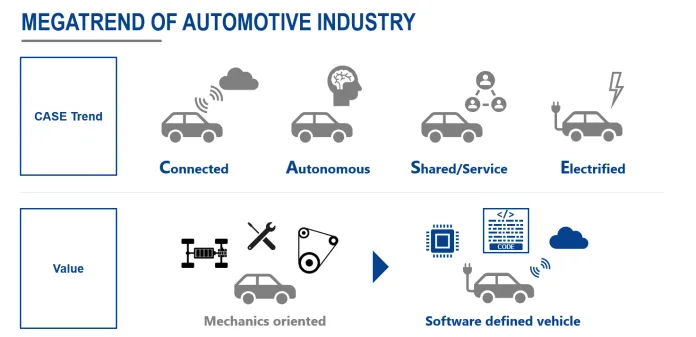

The automotive landscape is undergoing its most significant transformation since the invention of the assembly line. As we navigate through 2025, three powerful forces—electrification, autonomy, and connectivity—are reshaping not just how cars are built, but how we interact with them. The automotive trends 2025 forecast indicates a fundamental shift in how we think about transportation and mobility.

“We’re witnessing the birth of an entirely new relationship between humans and vehicles,” says Maria Chen, Chief Innovation Officer at GlobalMotor. “It’s no longer just about getting from point A to point B—it’s about what happens during that journey and how the vehicle becomes an extension of our digital lives.”

Let’s take a deep dive into the trends that are driving this revolution and what they mean for consumers, manufacturers, and society at large.

The Rise of Electric Vehicles in the Global Market

Electric vehicles are expected to account for over 20 million sales globally by 2025, representing a significant market shift. This surge isn’t happening in isolation—it’s the result of technological breakthroughs, changing consumer attitudes, and supportive government policies worldwide.

Unprecedented EV Market Growth Expected by 2025

Analysts project substantial EV market growth, with electric vehicles capturing 23% of the global light-vehicle market by 2025. This represents a remarkable evolution from just a few years ago when EVs were considered niche products.

| Year | Global EV Sales | % of Global Light-Vehicle Market |

|---|---|---|

| 2020 | 3.1 million | 4.2% |

| 2023 | 10.5 million | 14% |

| 2025 | 20+ million | 23% |

“The tipping point has arrived earlier than many expected,” explains Dr. Thomas Wright, automotive analyst at Future Mobility Institute. “Battery costs have fallen below the critical $100 per kilowatt-hour threshold, making EVs cost-competitive with internal combustion engines even without subsidies in many markets.”

Revolutionary Battery Technology for EVs on the Horizon

Advancements in battery technology for EVs, particularly solid-state batteries, promise to extend range while reducing costs. These next-generation power sources are expected to begin commercial deployment in premium vehicles by late 2025, offering energy densities up to 80% higher than current lithium-ion batteries.

Chinese manufacturers continue to dominate battery production, controlling approximately 75% of global capacity. However, new players from Europe and North America are making significant investments to reduce dependency on Asian supply chains.

“What we’re seeing is not just incremental improvement but fundamental innovation,” says Elena Patel, Chief Technology Officer at BatteryNext. “The solid-state batteries entering production will eventually enable EVs with 500+ mile ranges and charging times under 15 minutes.”

How Autonomous Vehicles Are Reshaping Transportation

Industry experts predict autonomous vehicles will generate a market worth $60.3 billion by 2025. While fully autonomous Level 5 vehicles (requiring no human intervention under any circumstances) remain on the horizon, Level 3 and Level 4 autonomy are becoming increasingly common on our roads.

Advancements in Autonomous Driving Technology

Investments in autonomous driving technology continue to accelerate as automakers race to bring self-driving capabilities to market. The technology stack—combining LiDAR, radar, cameras, and sophisticated AI—has matured significantly, enabling vehicles to navigate complex urban environments with increasing confidence.

“The real breakthrough has been in edge computing and neural networks,” explains Dr. James Kim, Director of Autonomous Systems at TechDrive. “Today’s systems can process sensor data and make driving decisions in milliseconds, even in unpredictable situations like construction zones or severe weather.”

The impact of autonomous vehicles on transportation extends beyond personal mobility to reshape logistics and public transit systems. Commercial applications are leading adoption, with autonomous trucking routes expanding across major highways and self-driving shuttles operating in controlled environments like corporate campuses and airports.

| Autonomous Vehicle Market Growth | Value |

|---|---|

| Market Size (2025) | $60.3 billion |

| Projected Market Size (2035) | $449 billion |

| CAGR (2025-2035) | 22.2% |

Connected Cars: The New Standard in Automotive Technology

The global market for connected cars is projected to reach $121 billion by 2025, more than doubling from 2020 figures. This explosive growth is fueled by advancements in 5G technology, cloud computing, and the Internet of Things (IoT).

The Emergence of Software-Defined Vehicles

The concept of software-defined vehicles is revolutionizing how manufacturers approach vehicle design and functionality. Modern vehicles now contain more than 100 million lines of code—more than a commercial airliner—managing everything from engine performance to entertainment systems.

“Cars are essentially becoming computers on wheels,” says Alex Rivera, Chief Digital Officer at ConnectAuto. “The hardware is increasingly standardized, while the software provides the differentiation and personalization that consumers demand.”

Emerging trends in connected car technology 2025 include enhanced IoT integration and 5G connectivity for real-time data processing. These advancements enable features like:

- Over-the-air updates that add new features throughout the vehicle’s lifetime

- Predictive maintenance that identifies potential issues before they cause breakdowns

- Personalized in-car experiences that adapt to individual preferences

- Vehicle-to-everything (V2X) communication for improved safety and traffic flow

Shifting Consumer Preferences Driving Industry Change

Consumer attitudes toward mobility are evolving rapidly, with significant variations across demographic groups. Studies reveal interesting patterns in consumer preferences for electric vehicles by generation, with Gen Z showing the highest interest at 54%.

| Generation | % Considering EV Purchase |

|---|---|

| Gen Z | 54% |

| Millennials | 48% |

| Gen X | 41% |

| Boomers | 32% |

“Younger consumers view cars differently than previous generations,” notes Sarah Johnson, consumer behavior researcher at AutoInsights. “They’re less concerned with traditional status symbols like horsepower and more interested in technology integration, environmental impact, and flexible ownership models.”

This shift is driving automakers to rethink their approach to vehicle design, marketing, and even business models. Subscription services, fractional ownership, and mobility-as-a-service offerings are gaining traction, particularly in urban areas where traditional car ownership is becoming less practical.

Global Manufacturing and Strategic Partnerships

The automotive industry’s transformation is reshaping manufacturing strategies and fostering unprecedented collaborations between traditional automakers and technology companies.

“The lines between automotive and tech are blurring,” explains Carlos Mendez, automotive industry consultant. “Companies that were once fierce competitors are now partners, pooling resources to tackle the enormous technical challenges of next-generation vehicles.”

Key developments include:

- Increased collaboration between automakers, suppliers, and tech firms

- Chinese brands like NIO, XPeng, and BYD expanding into European and North American markets

- Legacy manufacturers accelerating innovation through acquisitions and partnerships

- New manufacturing hubs emerging in Southeast Asia and Eastern Europe

Supply chain resilience has become a top priority following recent global disruptions. Automakers are investing in localized production and developing alternative sourcing strategies for critical components, particularly semiconductors and battery materials.

Looking Beyond 2025: The Road Ahead

While 2025 represents a significant milestone in the automotive industry’s transformation, the journey is far from complete. The future of electric vehicles in 2025 looks promising with younger generations showing increased interest in EV adoption, but the full transition to electric mobility will continue well into the 2030s.

Similarly, autonomous driving technology will continue to evolve, with Level 5 autonomy likely becoming commercially viable in the latter half of the decade. The regulatory framework governing these technologies is still developing, with significant variations across different regions.

“What we’re seeing is not just an evolution but a revolution,” concludes Dr. Wright. “The automotive industry of 2030 will bear little resemblance to what we knew just a decade earlier. The companies that thrive will be those that embrace this change rather than resist it.”

Also read- Foxconn EV: A Game Changer for Japan’s Auto Industry

FAQS

Will software updates for cars require subscription fees?

The automotive industry is increasingly adopting subscription models for certain premium features and services. By 2025, most vehicles will receive basic software updates for free, particularly those related to safety and core functionality. However, enhanced features like advanced driver assistance systems, entertainment options, or performance upgrades will increasingly be offered through subscription models or one-time purchases.