Top 5 EV Battery Stocks for 2025: Don’t Miss These Picks!

The electric vehicle (EV) revolution is here, and with it comes a massive opportunity for investors. As the world shifts toward sustainable transportation, the demand for high-performance EV batteries is skyrocketing. In India, the EV market is projected to grow from $3.2 billion in 2022 to a staggering $114 billion by 2029, with a CAGR of 66.52%.

At the heart of this transformation lies the EV battery industry, which is critical to powering the future of mobility. The Indian EV battery market alone is expected to surge from $16.8 billion in 2023 to $27.7 billion by 2028, driven by advancements in lithium-ion technology and government incentives.

If you’re looking to ride the EV wave, here are five EV battery stocks to watch in 2025. These companies are leading the charge in innovation, production, and market expansion.

1. Exide Industries: A Pioneer in Battery Manufacturing

Exide Industries is a household name in India’s battery market, with a strong presence in both automotive and industrial segments. The company is now making significant strides in the EV battery space.

Key Highlights:

- Lithium-Ion Expansion: Exide is investing ₹6,000 crore to set up a 12 GWh lithium-ion cell manufacturing facility, with Phase 1 expected to be operational by FY25.

- Strategic Partnerships: Its subsidiary, Exide Energy Solutions Limited (EESL), has signed an MoU with Hyundai Motors and Kia for strategic cooperation in the Indian EV market.

- Global Reach: Exide operates in 60+ countries and is debt-free, making it a financially stable player.

Financial Performance:

In the first half of 2024, Exide reported an EBITDA margin of 11.4% and a PBT margin of 9%, with plans to improve margins to 13-14% in the near term.

With its focus on lithium-ion technology and a robust distribution network, Exide is well-positioned to capitalize on the growing EV market.

2. Amara Raja Energy & Mobility: A Leader in Innovation

Amara Raja Energy & Mobility (ARE&M) is a key player in the Indian battery industry, known for its leadership in lead-acid batteries and its growing focus on lithium-ion technology.

Key Highlights:

- Giga Corridor: The company is investing ₹9,500 crore to set up a lithium-ion battery manufacturing facility in Telangana, with Phase 1 expected to be operational by FY26.

- Diverse Portfolio: ARE&M serves both automotive and industrial clients, with offerings ranging from EV batteries to energy storage systems.

- Global Expansion: The company is targeting export growth at a CAGR of 15% over the next 3-4 years, with a focus on Europe.

Financial Performance:

In Q2 FY25, ARE&M recorded revenue of ₹3,250 crore, with its lead-acid battery business contributing the majority. The company expects margins to sustain at 14-14.5% in the near term.

With its strong R&D capabilities and strategic investments, ARE&M is poised to be a major player in the EV battery market.

3. HBL Power Systems: A Niche Player with Big Ambitions

HBL Power Systems specializes in industrial and defense batteries, making it a unique player in the EV battery space.

Key Highlights:

- Diverse Offerings: The company manufactures VRLA, nickel-cadmium, and lithium-ion batteries for sectors like telecom, railways, and defense.

- Defense Focus: HBL is the only Indian manufacturer of pure lead-tin batteries and supplies to defense projects like Vande Bharat trains and missiles.

- Electronics Growth: Its electronics division, which includes train collision avoidance systems, has seen revenue growth of nearly 300% between FY22 and FY24.

Future Outlook:

HBL is investing ₹100 crore in FY25 to produce high-energy-density cells for defense applications. The company expects sales to grow 30% in FY26, driven by new tenders and product launches.

With its niche focus and strong growth potential, HBL Power Systems is a stock to watch.

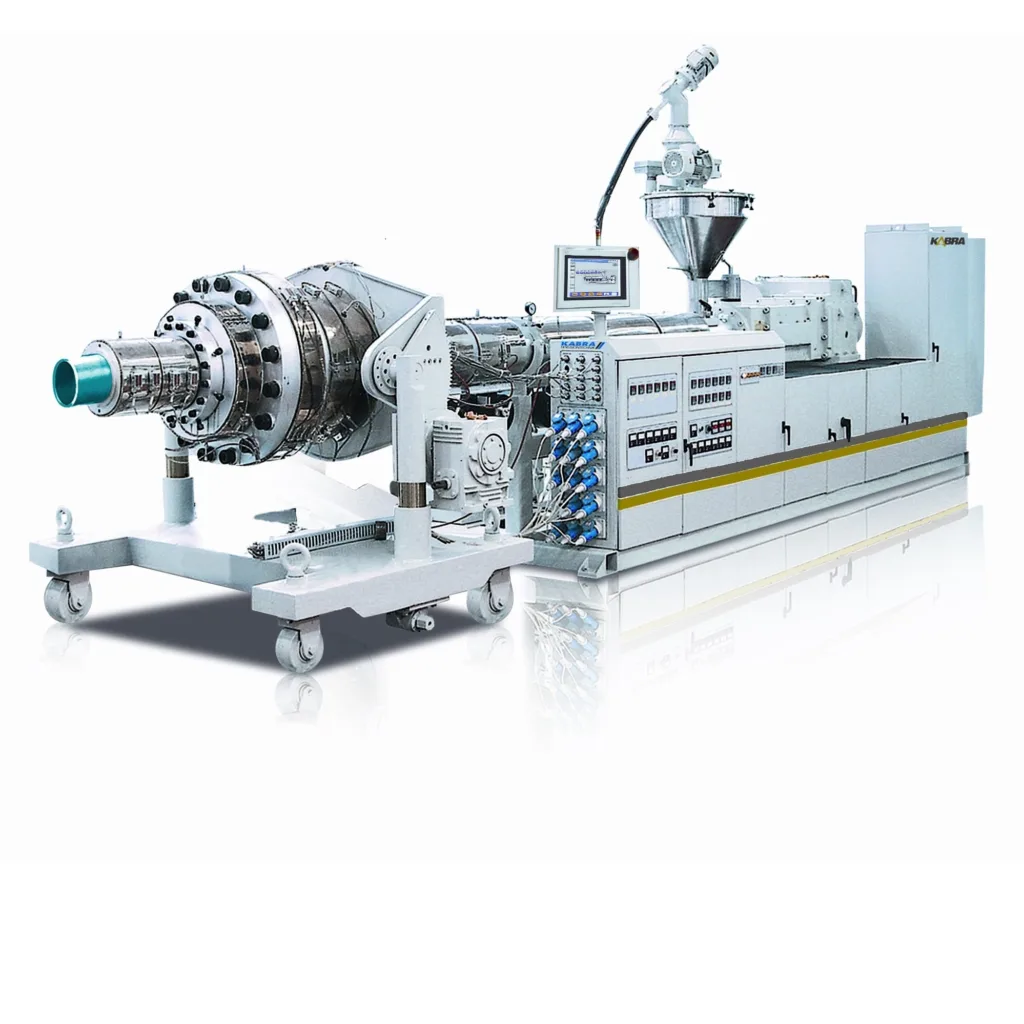

4. Kabra Extrusion Technik: A Rising Star in EV Batteries

Kabra Extrusion Technik (KET) is a leader in plastic extrusion machinery and a rising player in the EV battery market through its Battrixx division.

Key Highlights:

- Battery Division Growth: Battrixx manufactures lithium-ion battery packs and battery management systems (BMS) for electric 2Ws, 3Ws, and light commercial vehicles.

- Strategic Partnerships: Battrixx has partnered with Hero Electric to develop ultra-safe lithium-ion batteries for e-scooters.

- Market Share: The company holds an 18% market share in the battery division.

Financial Performance:

In Q2 FY25, KET reported revenue of ₹130 crore, with an EBITDA margin of 17%, the highest in 12 quarters.

With its focus on innovation and strategic partnerships, Kabra Extrusion Technik is well-positioned for growth in the EV battery market.

5. Ola Electric: The EV Giant with Big Plans

Ola Electric is India’s largest electric scooter manufacturer, with a 31% market share in the electric 2W segment. The company is now expanding into EV battery production.

Key Highlights:

- Gigafactory: Ola is setting up a Gigafactory in Tamil Nadu to produce lithium-ion cells, with production expected to begin by Q1 FY26.

- Vertical Integration: Ola’s in-house production of motors, cells, and electronics gives it a competitive edge in cost and performance.

- Expanding Network: The company plans to increase its store network to 2,000 locations by March 2025.

Financial Performance:

In Q2 FY25, Ola reported revenue of ₹1,240 crore, driven by a 73.6% YoY increase in deliveries. The company’s gross margins stood at 20.6%, with plans to achieve steady-state margins above 30%.

With its aggressive expansion plans and focus on technology, Ola Electric is a key player to watch in the EV battery space.

Conclusion

The EV revolution is reshaping the automotive industry, and battery manufacturers are at the forefront of this transformation. Companies like Exide Industries, Amara Raja Energy & Mobility, HBL Power Systems, Kabra Extrusion Technik, and Ola Electric are leading the charge with innovative solutions and strategic investments.

As the demand for sustainable transportation grows, these stocks offer significant growth potential for investors. However, always conduct thorough research and consult with financial advisors before making investment decisions.

Stay tuned for more updates on the EV market and investment opportunities!