Electric Vehicle Sales Soar 14% in November: Tata Faces Challenge!

The electric vehicle (EV) market in India continues to show resilience, with electric vehicle sales and SUVs rising by 14% in November 2024, totaling 8,600 units. This increase comes on the heels of a record-breaking October, where sales reached an impressive 11,165 units. Despite the slowdown, November marks the third-best month for EV sales this year, and cumulative sales from January to November have surpassed the total for all of 2023.

November Sales Overview

In November 2024, the total sales of electric passenger vehicles (PVs) reached 8,596 units, a notable increase from the 7,550 units sold in the same month last year. This growth is particularly significant when compared to the 17-month low of 6,148 units recorded in September 2024. The total sales for the year so far stand at 89,557 units, reflecting a 19% year-on-year increase from 75,051 units in the same period last year.

Tata Motors: Market Leader Faces Pressure

Tata Motors, the longstanding leader in the Indian EV market, sold 4,196 units in November 2024, marking an 18% decline from the 5,124 units sold in November 2023. This drop has resulted in a significant decrease in market share, falling to 49% from 68% a year ago. Despite this, Tata Motors has maintained a cumulative sales figure of 57,084 units for the year, up 4% from the previous year.

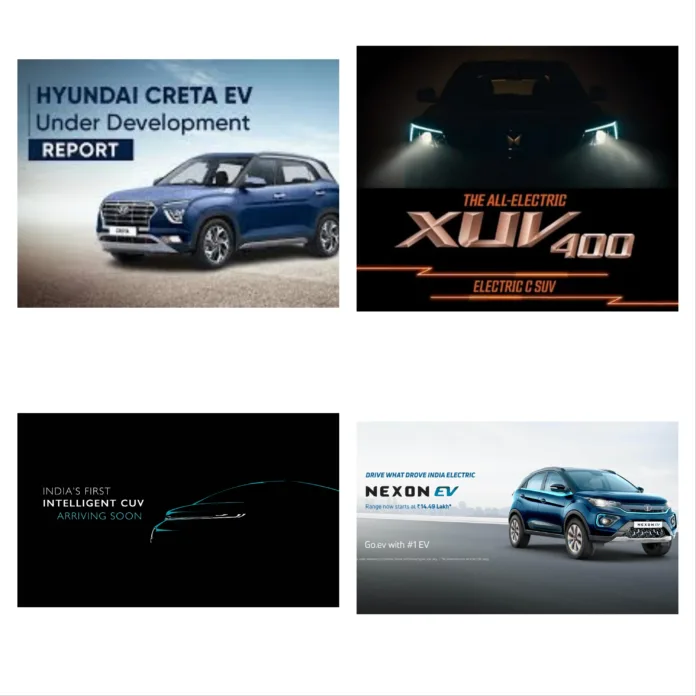

The company’s diverse EV portfolio includes popular models like the Nexon EV, Tigor EV, and the recently launched Curvv EV. To enhance customer experience, Tata Motors is also offering six months of free charging at over 5,500 Tata Power charging points across the country.

JSW MG Motor India: A Rising Star

In contrast, JSW MG Motor India has seen remarkable growth, with sales skyrocketing by 227% year-on-year to 3,126 units in November 2024. This surge has propelled the company’s market share to 36%, up from just 13% in November 2023. The success of the Windsor EV, priced at ₹13.49 lakh, has been a key driver of this growth, along with the innovative Battery-as-a-Service (BaaS) model that allows customers to pay only for battery usage, significantly lowering the initial cost of ownership.

JSW MG Motor plans to expand its sales network, targeting Tier 3 and Tier 4 cities, with plans to establish 100 new touchpoints by the end of 2024.

Other Competitors in the EV Space

Mahindra & Mahindra sold 547 units of its XUV400 electric SUV in November, reflecting a modest 1% increase year-on-year. The company has ambitious plans to ramp up production with an investment of ₹12,000 crore in its EV program.

BYD India also reported strong growth, selling 326 units in November, a 133% increase from the previous year. The company is exploring new models to enhance its presence in the Indian market.

In contrast, Hyundai Motor India faced challenges, selling only 20 units of the Ioniq 5, an 88% decline from the previous year. However, the company is set to launch the much-anticipated Creta EV in 2025, which is expected to boost sales.

Luxury EV Market Trends

The luxury EV segment saw a sharp decline in November, with sales dropping 48% to 228 units. However, cumulative sales for the first 11 months of 2024 are up 12% year-on-year, totaling 2,533 units. BMW India remains the leader in this segment, while Mercedes-Benz India has also seen significant growth.Stay tuned for more updates on EV Market as we continue to track the developments in this dynamic industry!