In an effort to revive interest in its electric vehicle import program, the Indian government is planning to hold a workshop. The plan has received little attention, despite the initial high expectations, which has led to additional stakeholder input.

The Indian government is holding a workshop for businesses interested in importing high-end electric vehicles at reduced import taxes in an attempt to rekindle interest in its EV import program. This project intends to collect input and comprehend the causes of the low level of interest in the program, which was first introduced with great anticipation.

Govt of India Future Plan about Electric Vehicle

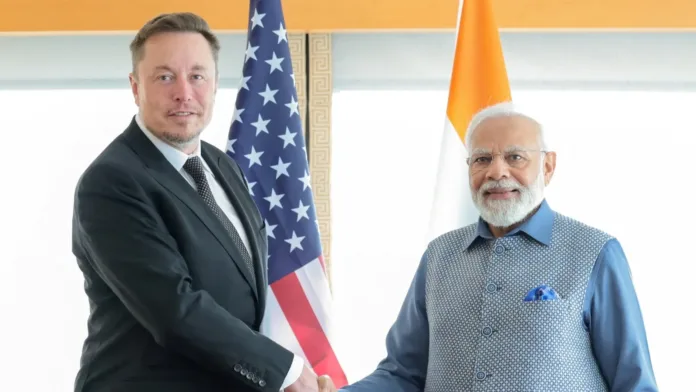

India launched a program last year that offers lower import taxes in an effort to promote the import and domestic manufacturing of luxury electric cars. The goal of this action was to draw in big EV manufacturers, namely Tesla, who had previously indicated interest in joining the Indian market in exchange for lower import taxes. However, the government has had to re-engage with stakeholders because the reception to the initiative has been less enthusiastic than expected. The government intends to hold a workshop for businesses interested in the program later this month.

This workshop will provide businesses a chance to learn more about the plan and submit input that may affect the final rules. The first phase of consultations, which included big businesses including Tata Motors, Maruti Suzuki, Hyundai, BMW, and Mercedes, took place in April 2024. This will be the second round. The Asia Group, Tesla’s representative in India, was also present at the conference.

Only a small number of businesses have expressed a strong desire to join the program in spite of these efforts. Companies can import electric vehicles with lower tariffs under the Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI) if certain requirements are met. Businesses must construct EV factories or install EV charging stations, or invest at least $500 million (about ₹4,150 crore) over five years. Businesses have three years to reach a minimum of 25% domestic value addition (DVA), and five years to reach 50%. Approved businesses are able to import electric cars for a 15% customs duty discount, instead of the standard higher rate, for vehicles that cost $35,000 or more.

At this reduced pricing, businesses can also import up to 8,000 electric vehicles each year, with any unused import permits carried over to the next year. Few businesses have made the commitment to achieve the high investment and localization criteria in spite of these advantages. The government anticipates that additional consultations will help determine whether businesses require additional incentives or whether changing the rules could increase participation. Major firms like VinFAST and Tesla are keeping an eye on the scheme’s progress, so the government’s answer might have a big impact on India’s EV market in the years to come.